Picture this – you currently own or want to buy a home with good bones, but it needs some TLC. The good news is that you don’t have to handle a home remodel alone. Renovation loans are a great option to help fund home improvements, repairs, and enhancements by rolling the renovation costs into a single mortgage payment. It’s important to understand how renovation or home improvement loans work, types of renovation loan options, and benefits.

What Is a Renovation Loan?

Renovation loans are designed to help borrowers finance home improvement projects that will increase the value of the home. Whether you’re planning a small home makeover or extensive rehab project, a renovation loan combines a traditional purchase or refinance mortgage with the cost of renovations—it is an all-in-one mortgage financing option that covers the upfront costs of large repairs and projects.

Taking on the remodel before moving in can enhance your living space and home functionalities without the pressure of taking out an additional loan or paying out of pocket for costly repairs in the future.

Types of Renovation Loans

When it comes to renovation loans, there are a few options for prospective homebuyers and homeowners to consider based on eligibility, timing, and the scale of the home improvements needed.

FHA 203(k) Renovation

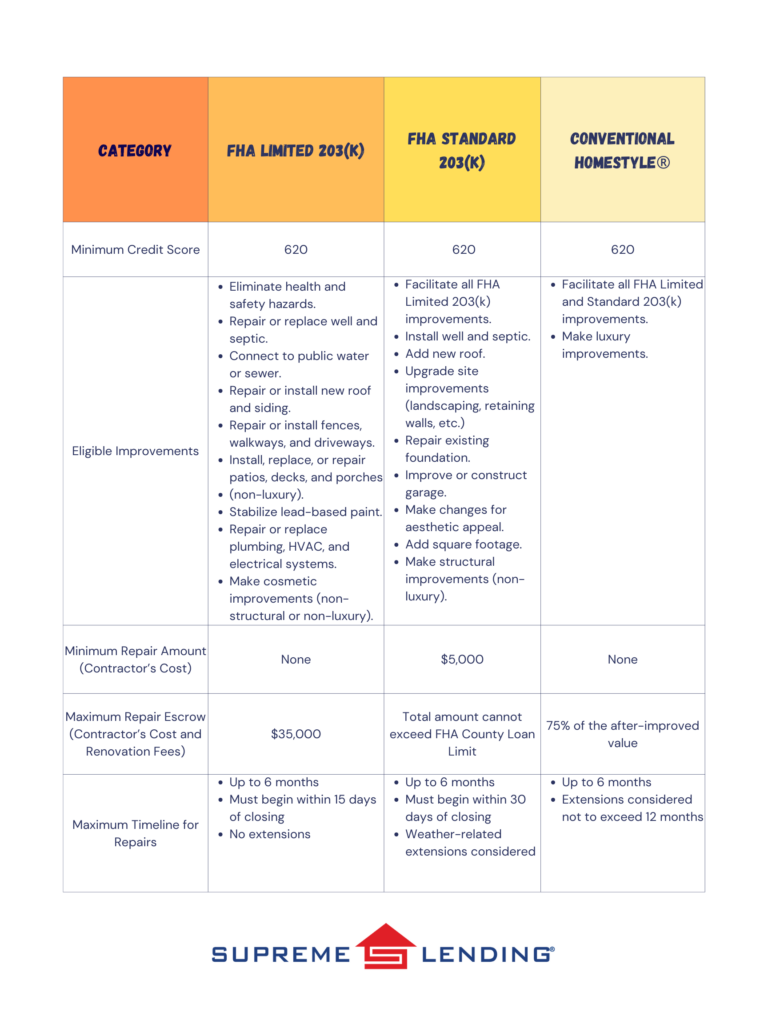

An FHA 203(k) loan, or an FHA rehab loan, is insured by the Federal Housing Administration and provides two options depending on the scope of the home improvement projects, including Limited 203(k) and Standard 203(k), offering different levels of renovation financing.

The minimum down payment for an FHA 203(k) loan is 3.5%. An FHA 203(k) loan covers common basic home improvements and repairs but excludes larger luxury projects and amenities. The Limited option has no minimum renovation amount and can cover up to $35,000 in renovation costs. The Standard has expanded eligible improvements including some structural upgrades and a minimum renovation cost of $5,000. Typically, all renovations must be completed within 6 months.

VA Renovation

The Department of Veterans Affairs (VA) also has a Renovation loan option. A VA Renovation loan offers 100% financing for eligible U.S. Veterans or military personnel to cover a mortgage combined with planned renovation costs into a single loan. Eligible home improvements are similar to FHA 203(k) to cover common upgrades that will make the property safer, healthier, or more functional, excluding luxury projects. VA Renovation loans can finance up to $50,000 in home repair costs.

Conventional Renovation

A Conventional Renovation loan, such as Fannie Mae’s HomeStyle® program, is another financing option that rolls the costs of home renovation projects into a single mortgage and offers more flexibility than a government loan. Conventional Renovation mortgages can cover larger, luxury upgrades, such as creating a high-end bathroom or kitchen with decorative tilework or adding a sparkling backyard pool. The maximum home repair amount is 75% of the home’s post-construction appraised value.

More Benefits of Renovation Loans and Remodeling

- Expand Your Home Search. Prospective homebuyers may have a broader range of properties to choose from, including fixer-uppers, knowing that they could finance custom home upgrades or needed repairs with a Renovation loan.

- Save on Upfront Costs. Home renovation projects can be costly. Funding home remodeling projects with your mortgage could help keep you from tapping into your personal savings and avoid hefty upfront repair costs.

- Grow Your Home Value. Renovation loans are intended to increase the value of your home, which may result in a smart, long-term investment and the potential to build more equity.

- Personalize Your Dream Home. Renovation loans offer an affordable option to help make your design visions come to life and beautify your home to fit your character.

- Enhance Comfort and Livability. Whether it’s expanding a kitchen, adding a bathroom, or creating a home office space, upgrading your home can add modern conveniences and improve your overall well-being.

If you’re looking to enhance your living spaces and potentially increase your property value, a Renovation loan could be the answer to creating the home of your dreams. To learn more about renovation financing or other mortgages, contact your local Supreme Lending branch today.

Related Articles: