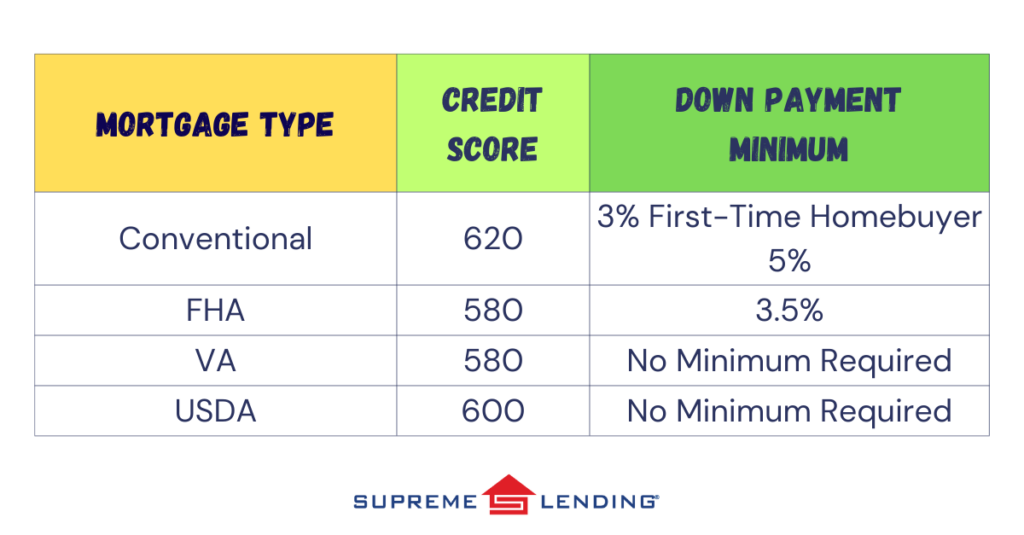

For aspiring homeowners and first-time buyers, many questions can arise about the mortgage process. What credit score do you need to qualify? How much down payment is required? Answers are based on several factors including the property, purchase price, and, most importantly, the mortgage type.

Here’s a breakdown to simplify the numbers and help you understand what you need to open the door to your dream home depending on common mortgage types:

What Is a Credit Score?

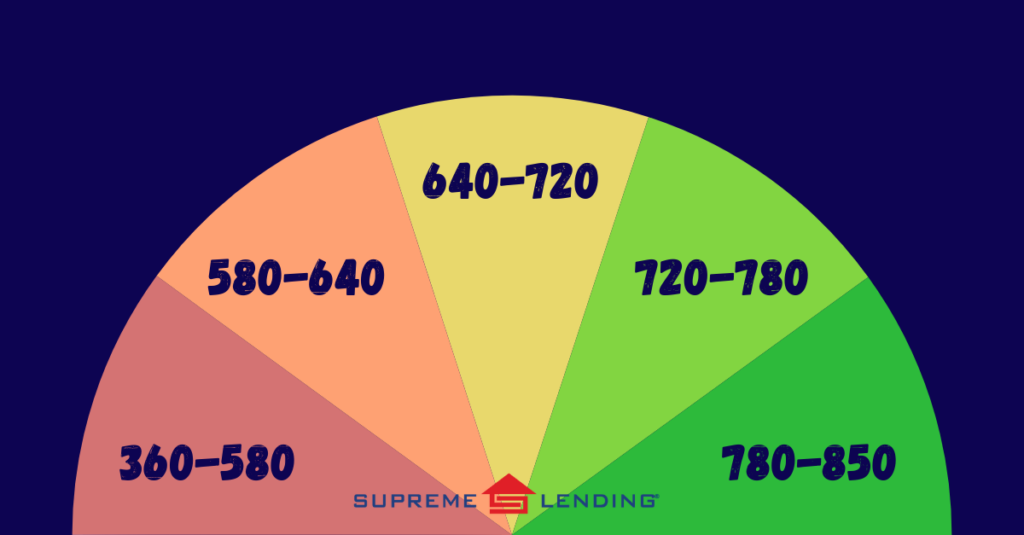

Commonly determined by FICO® score, credit scores are calculated using the borrower’s financial background information such as payment history, credit utilization, length of credit history, types of credit in use, and recent credit behavior. The average credit score in the United States in 2023 was 715, according to Experian data.

Down Payment Assistance Options

If a homebuyer doesn’t have the required minimum down payment or would like to access more financing, Supreme Lending offers several down payment assistance options for qualified buyers. This can also help first-time buyers open the door to homeownership. Guidelines and eligibility vary depending on the program. For example, the Supreme Dream program offers down payment assistance in the form of a fully forgivable second loan and requires a minimum credit score of 620. Ask your Supreme Lending Loan Officer about qualified assistance programs.

Understanding credit score and down payment requirements for different types of mortgages is crucial for prospective homebuyers. While each loan type has its own guidelines, maintaining a good credit score and having sufficient funds for upfront costs at closing remains a common denominator for securing favorable terms and interest rates. By proactively managing your credit and staying informed about your options, you can navigate the mortgage process with confidence on your journey to homeownership.

Contact your local Supreme Lending branch to get pre-qualified and learn about your home financing options.