Are you interested in investment property loans, but not sure where to begin? Investing in real estate may offer exciting and rewarding opportunities, including rental income. In fact, HousingWire reported that investment returns for single-family rental homes are expected to rise in 2024 due to rent increasing quicker than home prices.

As you can imagine, financing an investment property differs from securing a traditional mortgage for a primary residence. Here’s an overview of investment home financing, unique aspects of investment property loans versus traditional mortgages, and other considerations. Additionally, discover highlights from Supreme Lending’s investment mortgage options.

What Is Investment Property Financing?

Investment property loans are specialized mortgages designed to finance the purchase, renovation, or refinancing* of properties intended for investment purposes. There are several mortgage options to finance investment homes, such as DSCR loans and Conventional options. Common investment properties may offer short-term rentals, fix and flip, or longer-term ventures.

*By refinancing an existing loan, total finance charges may be higher over the life of the loan.

Types of Investment Properties

Eligible properties for investment financing can vary depending on the lender and the mortgage program. However, common property types include single-family residences, townhomes, 2-4 unit properties, and condos.

What’s the Difference Between Investment Property Loans and Primary Home Loans?

Investment properties may require a higher down payment due to potentially higher lending risk versus a primary home. Unlike a primary residence, an investment property is not occupied by the borrower. Additionally, lenders often require a higher credit score for investment loans than other mortgages such as FHA loans, which are designed for primary residences.

Supreme Lending’s Popular Investment Property Loans

- DSCR Loans. Debt Service Coverage Ratio (DSCR) financing is intended specifically for investors looking to purchase income-generating properties. Lenders review the property’s ability to generate adequate income to cover the mortgage payments. This means no personal employment verification or income analysis is required.

- The RISE Program. Supreme Lending’s RISE (Real Estate Investment Strategy and Expansion) loan is a DSCR option that offers flexible financing with competitive rates and terms. A key feature includes no limit to the number of investment properties and eligible Foreign National borrowers are accepted.

- Conventional Investment Property Loans. Investors may opt for Conventional financing for a lower down payment requirement and credit score minimum. This could also be a good option for first-time buyers to get their foot in the door of real estate investing.

- The Investment Edge Program. Supreme Lending’s Investment Edge is a Conventional option that frequently offers more competitive rates if the property meets additional criteria. This includes only purchases with 75% Loan-to-Value (LTV) or lower. Standard Conventional underwriting guidelines apply.

- Bank Statement Loans. A bank statement loan can be a great alternative for self-employed borrowers looking to purchase investment properties. Borrowers can elect to use personal or business bank statements for 12- or 24-months. The more bank statements provided the better the rate.

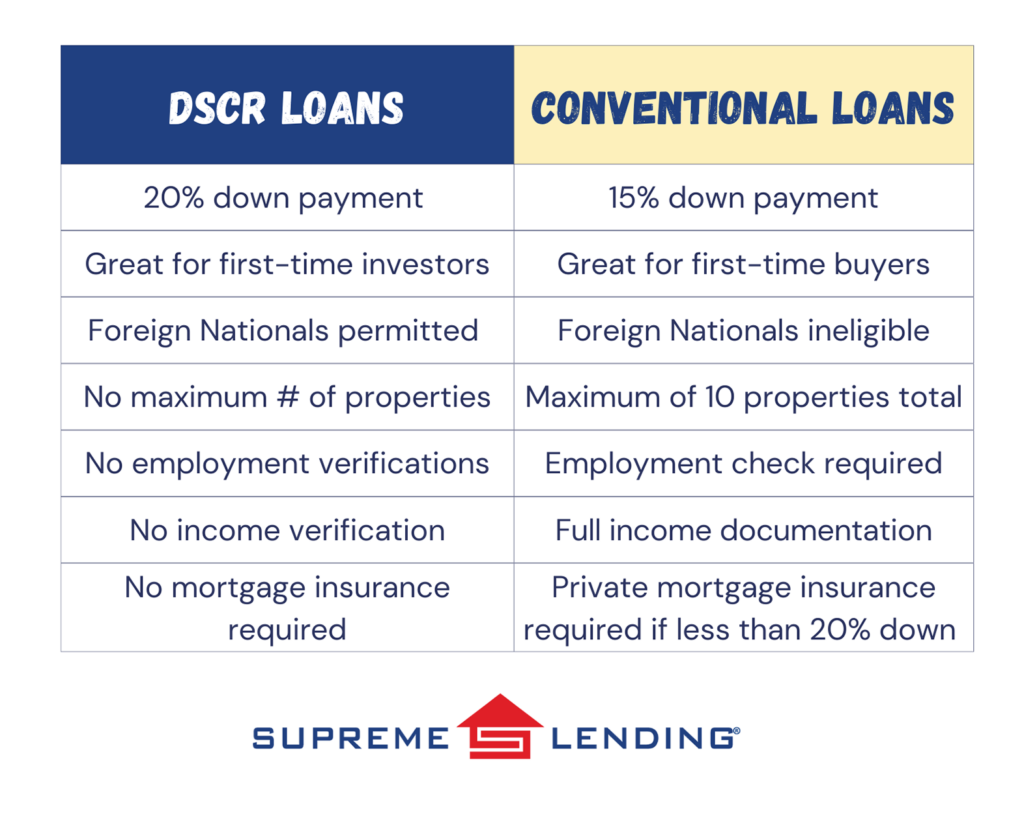

Investment Property Financing: Conventional vs. DSCR

Here’s a side-by-side comparison of DSCR and Conventional features for investment property loans.

Investment Property Considerations

In addition to the mortgage, when looking to purchase a residential investment property, it’s important to consider other key factors that could impact your investment. Here are some considerations to keep in mind:

- Location, location, location. It’s important to find out if there’s market demand for rental properties or people moving to the area. You may consider if the property is within a sought-after school district, centrally located for accessible transportation, or near desired lifestyle amenities and entertainment.

- Property condition. Review the home appraisal and inspection to determine any issues. Evaluate any potential repairs that may be needed. If you’re planning to renovate, understand and calculate possible rehab costs.

- Property management. Be sure to determine how the investment property will be managed. Whether self-managed or through a third-party property management firm, factor in any associated costs. Additionally, consider any on-going home maintenance you may need to be responsible for to keep your investment home safe and habitable.

Investing in residential real estate is a significant move, and securing the right financing for your home is imperative. Supreme Lending is here to help you navigate the complexities of investment property loans with ease and confidence. Whether you’re a seasoned investor or just starting out, our team of experienced mortgage professionals is ready to assist you every step of the way. Contact your local branch today to get started.