Home Appraisal Checklist: Key Factors to Consider

Your Quick Home Appraisal Checklist

When buying or selling a home, it’s important to understand the importance of a home appraisal during the mortgage process. Appraisals determine the value of a property based on various factors, ensuring buyers, sellers, and lenders are aligned on what the home is worth. Knowing what appraisers look for can help ensure a smooth mortgage process and avoid last-minute surprises or delays. Read on for an overview of the appraisal process including a home appraisal checklist for homeowners, buyers, and real estate agents to consider.

What Is an Appraisal?

An appraisal is an independent assessment of a property’s market value led by a licensed appraiser. The value is based on evaluating several aspects of the home, such as the condition, location, and recent sales of comparable properties in the area. The appraisal is an essential step of the mortgage process required by most lenders to verify that they’re not lending more than the home is worth. For buyers, a home appraisal can also offer reassurance that they are paying a fair price.

The Home Appraisal Checklist: What Appraisers Look For

Here’s a quick look at some key elements appraisers may consider when evaluating a property. You can use this guide when searching for a home or preparing to sell.

1. Home Size and Layout

- What is the total square footage and number of bedrooms and bathrooms?

- Is the layout of the rooms and spaces functional.

- Is there a finished basement or attic that adds to the livable space?

2. Exterior Condition

- Roof: Are there any missing shingles, leaks, wear and tear, etc.?

- Foundation: Are there visible cracks or settling issues?

- Siding, windows, and doors: Check for any damage, peeling paint, or outdated fixtures.

- Landscaping: Is it overgrown or neglected?

3. Interior Condition

- Walls, ceilings, and floors: Are there any cracks, stains, or general wear and tear?

- Kitchens and bathrooms: Is there any damage, outdated appliances, or broken equipment? Are there luxury upgrades that may boost the home’s value?

- Plumbing and electrical: Are the systems up-to-code, functional, and safe?

4. Lot Size and Usability

- How large is the lot?

- Is it safe and functional?

5. Upgrades and Amenities

- Are there any recent home improvements, such as a kitchen remodel, energy-efficient updates, or a new roof?

- Are there unique amenities such as a pool, outdoor kitchen, or wine cellar?

6. Safety and Compliance

- Appraisers will check for safety hazards or code violations.

- Factors like missing handrails, faulty wiring, or broken windows can negatively impact the appraisal.

7. Location & Neighborhood

- Appraisers will examine the property’s location, including proximity to schools, parks, shopping centers, and other amenities.

- Neighborhood conditions, crime rates, and overall desirability can also impact the value.

8. Comparable Sales (Comps)

- Appraisers will compare the home to the sales of similar properties in the neighborhood.

- Factors such as home size, condition, and location are considered to provide a rough benchmark.

Preparing a Home for an Appraisal: Tips for Sellers and Agents

Keeping the home appraisal checklist in mind, there are some measures that sellers or listing agents may consider to prepare for an appraisal and potentially maximize a home’s value.

- Make Minor Repairs As Needed. Fix any small but noticeable issues, such as leaky faucets, old paint, stained carpet, and broken hardware. Minor fixes may go a long way in improving a home’s appraisal value.

- Clean and Declutter. A clean, organized home allows the appraiser to focus on the property’s key features rather than clutter. This step can also enhance the home’s overall appearance.

- Highlight Recent Upgrades. If the home has undergone significant improvements, provide the appraiser with a list of updates, including the dates and cost of renovations.

- Provide Easy Access. Make sure that the appraiser can navigate to all areas of the home, including the basement, attic, and other outdoor structures.

Frequently Asked Questions About Appraisals

1. What is the difference between a home appraisal and a home inspection?

A home appraisal determines the market value of the property, which is essential for lenders to approve the loan amount. A home inspection, on the other hand, assesses the condition of the home and identifies any potential issues or repairs that may need to be addressed. While an appraisal focuses on value, an inspection focuses on the home’s livability.

2. What happens if the home appraises for less than the sale price?

If the appraisal comes in lower than the agreed-upon sale price, the buyer and seller may need to renegotiate. The buyer could request the seller to lower the price, or the buyer may need to pay the difference out of pocket.

3. Do you need an appraisal when refinancing?

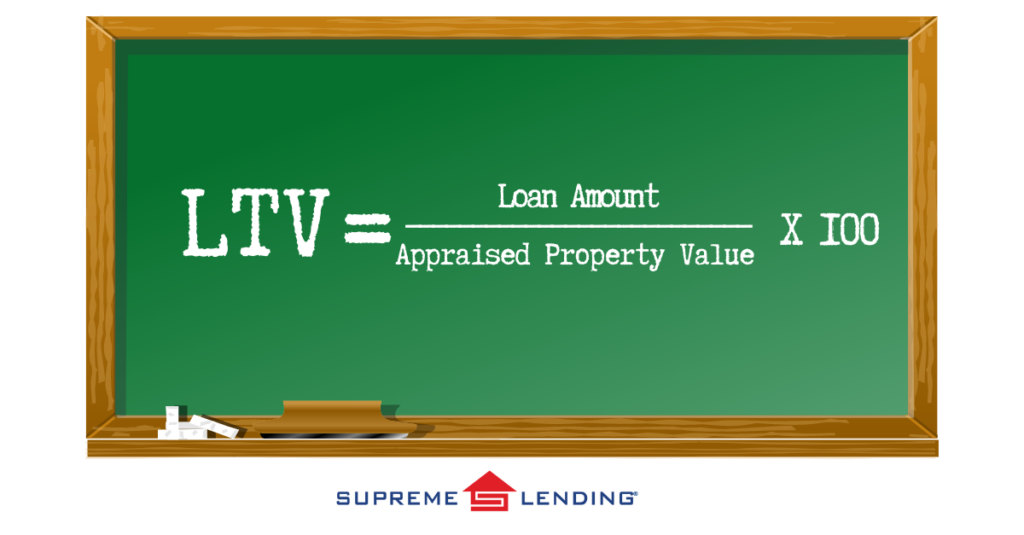

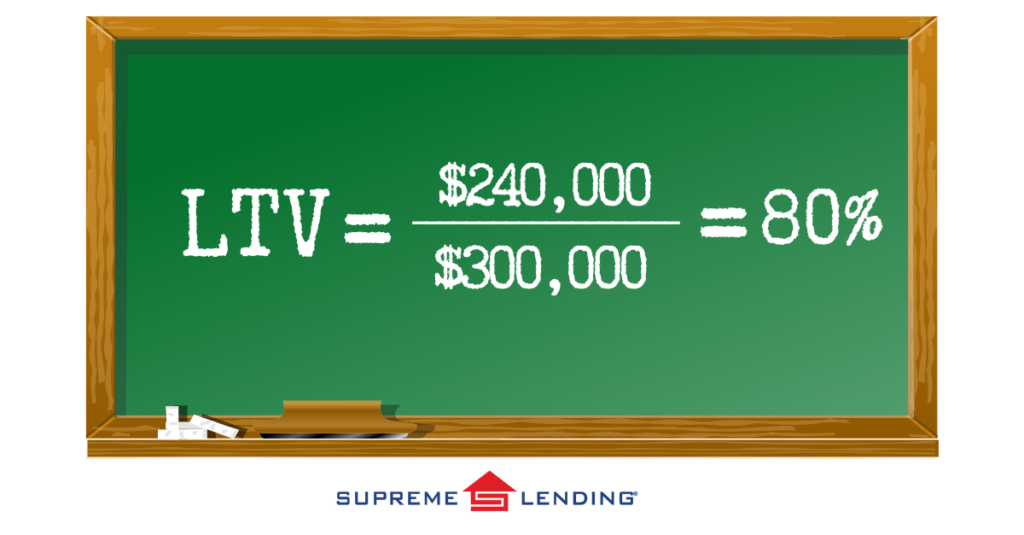

Yes. When refinancing,* it’s essential to understand the home’s current market value, especially if you’re taking cash out of your home equity. The appraisal also plays a key role in determining the Loan-to-Value ratio, which can affect loan terms, interest rate, and whether private mortgage insurance may be required.

*By refinancing an existing loan, total finance charges may be higher over the life of the loan.

What’s Next?

A home appraisal is one of the most important steps in the mortgage process. Once the appraisal is complete, the report is submitted to the lender for review. The lender reviews the appraisal report to verify the property’s appraised value aligns with the loan amount. When all loan conditions are met, it’s smooth sailing to closing.

Whether buying, selling, or listing a home, understanding the home appraisal checklist can help make the mortgage process smooth and seamless.

For more information about mortgages and steps of the loan process, contact your local Supreme Lending team today!

Related articles:

- All You Need to Know About Appraisals During the Homebuying Process

- 9 Steps of the Mortgage Process: From Pre-Qualifying to Closing