by Supreme Lending | Jul 26, 2024

Don’t let mortgage myths get in the way of your dreams of homeownership. Unfortunately, there are several misconceptions about home financing that can make getting approved for a loan seem more difficult than it could be. Supreme Lending is here to set the record straight and help you navigate the steps of the mortgage process with the knowledge you need. Let’s debunk these six common mortgage myths and uncover your homebuying possibilities.

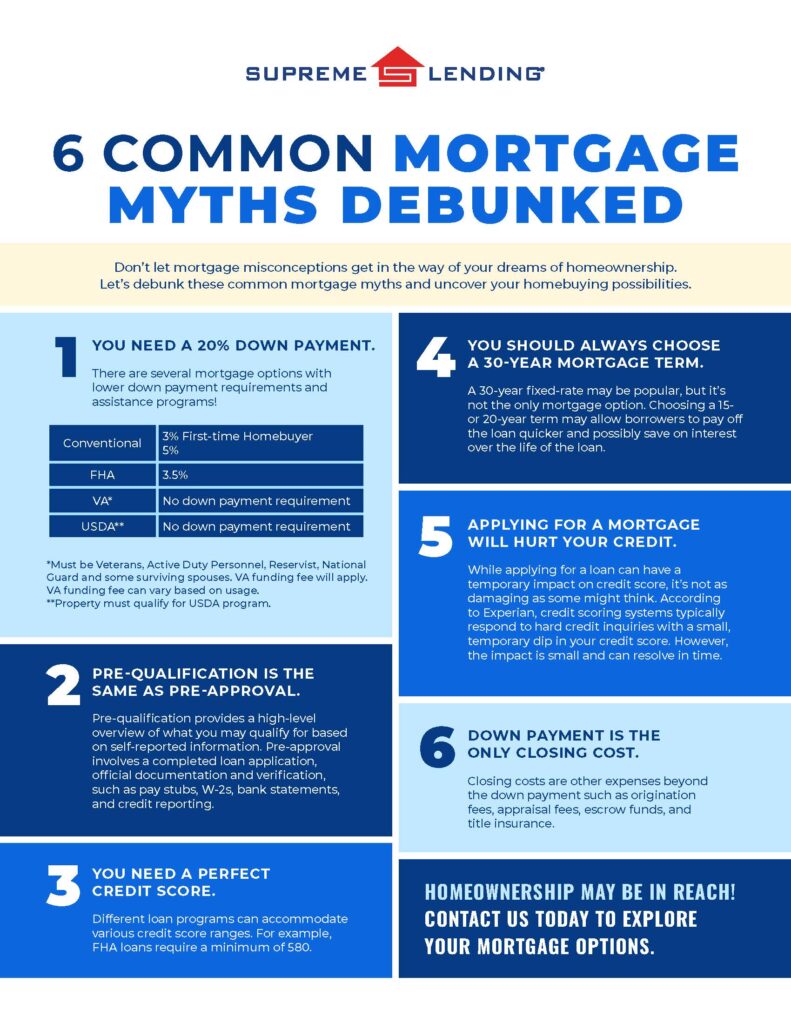

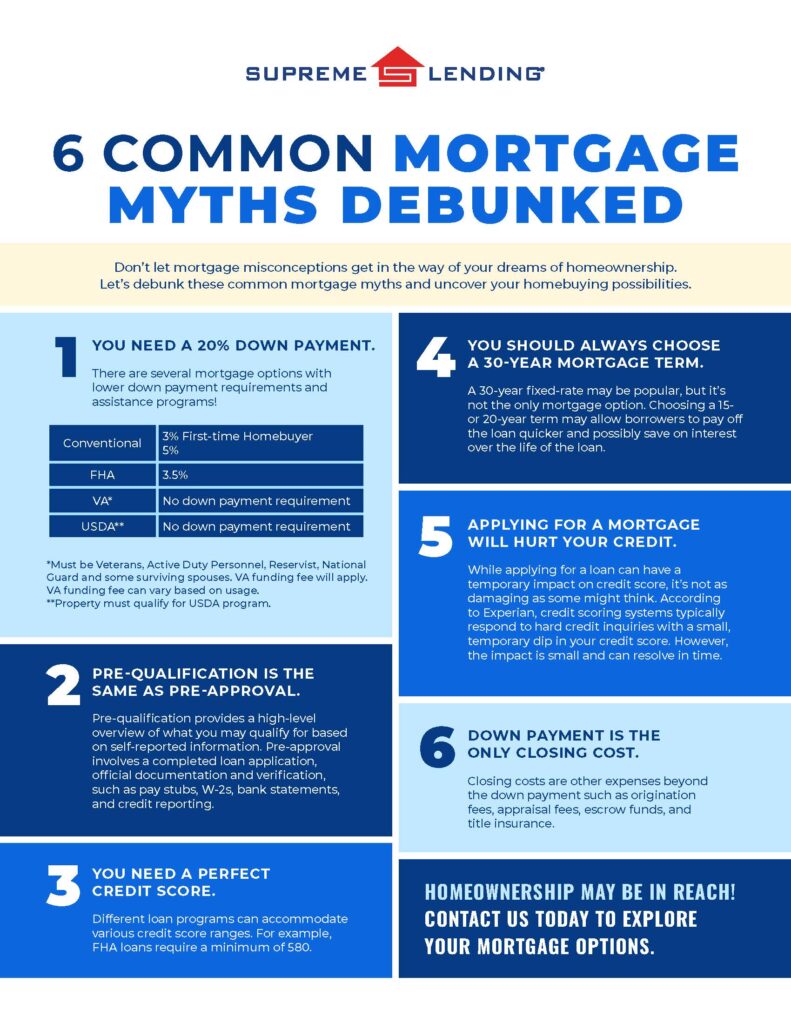

#1 Myth: You Need a 20% Down Payment.

Believing that you must have at least a 20% down payment saved up for a home may be one of the most common mortgage myths of all. When in fact, there are several loan options with lower down payment requirements.

For example, Conventional loans can require as low as 3% down for first-time homebuyers and 5% for repeat buyers. FHA loans require 3.5% down, serving as another affordable option. VA* and USDA** loans are unique in that they require zero down payment. There are also several down payment assistance programs for eligible homebuyers depending on various factors such as income or geographic location.

Why 20% Down?

The 20% myth may be misunderstood because of private mortgage insurance (PMI). If you don’t put down 20% for a Conventional loan, lenders will typically require you to have PMI, which is an added cost to your monthly mortgage payment. It’s important to note that if a borrower reaches a specified equity threshold in their home, mortgage insurance may be removed.

#2 Myth: Pre-Qualification Is the Same as Pre-Approval.

Nope. These terms are often used interchangeably but they are not the same when it comes to where you are in the loan process. Both provide an estimate of how much you may be able to afford for your monthly mortgage payments. However, the key difference between a mortgage pre-qualification and pre-approval is how lenders verify your information.

Pre-qualification is a high-level mortgage estimate based on self-reported information, such as income, debts, and assets. Plus, it’s oftentimes quicker to obtain.

On the other hand, a pre-approval takes a more detailed approach. This involves a completed loan application. Homebuyers must provide thorough documentation of financial history such as pay stubs, W-2s, and bank statements for verification. To get pre-approved, lenders will also verify your credit and employment.

#3 Myth: You Need a Perfect Credit Score.

A recent study found that people either don’t know or significantly overestimate the minimum credit score required for a typical mortgage, reported by Mortgage Professional America. While a higher credit score may help you secure more favorable mortgage rates or qualify for a higher loan amount, you don’t need to have flawless credit.

Different loan programs can accommodate various credit score ranges. For example, FHA loans are designed to make homeownership more accessible by accepting lower credit scores, a minimum requirement of 580.

#4 Myth: You Should Always Choose a 30-Year Mortgage Term.

A 30-year fixed-rate may be one of the most popular mortgages, but it’s not the only one to choose from. Depending on your situation or long-term goals, other mortgage terms may be a better fit. Whether it’s a 15-year term to pay the loan off quicker, or a 20-year term, Supreme Lending offers a wide range of options that can be tailored to match your needs.

#5 Myth: Applying for a Mortgage Will Hurt Your Credit.

While applying for a loan can have a temporary impact on your credit score, it’s not as damaging as some might think. When you apply for a new loan, lenders will pull your credit. This is also known has a hard inquiry for your credit report. According to Experian, credit scoring systems typically respond to hard credit inquiries with a slight, temporary dip in your credit score by a few points. However, the impact is small and can resolve in time.

Additionally, once approved for a mortgage, making on-time monthly payments may strengthen your credit in the long run.

#6 Myth: Down Payment Is the Only Closing Cost.

The down payment is a key part of closing a loan but isn’t the only cash you need to finalize your mortgage. Closing costs are other expenses beyond the down payment such as origination fees, appraisal fees, escrow funds, and title insurance. These costs will be outlined in the closing disclosure.

In addition, some lender programs allow borrowers to buy discount points to reduce their interest rate. This is essentially buying down the rate to save in interest over time. One discount point would equal 1% of the loan amount and would be included as a closing cost.

Understanding the Mortgage Process

Buying a home is one of the most significant purchases you can make. It’s crucial you’re properly informed about the loan process. By debunking these common mortgage myths, we hope to empower you with the knowledge needed to make informed decisions.

At Supreme Lending, we’re dedicated to providing personalized service and expert guidance throughout your homebuying journey. If you have any questions or want to explore your mortgage options, contact us today!

*Must be eligible Veterans, Active Duty Personnel, Reservist, National Guard, or qualifying surviving spouses. VA funding fee will apply. VA funding fee can vary based on usage.

**Property must qualify for USDA program.

by Supreme Lending | Apr 17, 2024

House hunters who are interested in larger or more expensive homes that could exceed certain conforming loan thresholds may need to consider a Jumbo loan program. If you’re dreaming big in your homebuying journey, discover what exactly a Jumbo loan is, qualification requirements, and helpful considerations when looking into a Jumbo loan option.

What Is a Jumbo Loan?

To understand conforming loans, you first need to understand conforming loans, which have maximum loan amounts set by the Federal Housing Finance Agency (FHFA). The 2024 conforming loan limit in most of the country is $766,550, though this may vary depending on the county in which you’re looking to purchase a property. If a loan amount is larger than this, then it’s considered a Jumbo loan.

The FHFA establishes conforming loan limits to regulate the maximum size of loans that government-sponsored enterprises (GSEs) like Fannie Mae and Freddie Mac can purchase or guarantee. These limits are put in place to ensure stability and liquidity in the mortgage market and to promote affordable homeownership. Because of this, Jumbo loans present a higher risk to lenders and often have different requirements than conforming loans.

For example, down payment requirements for Jumbo loans are typically higher, around 20% or more of the loan amount. They may also require private mortgage insurance (PMI) or carry higher interest rates than conforming loans.

Differences Between Jumbo Loans and Conforming Loans

Let’s go over the direct differences in qualifications and other areas between Jumbo loans and conforming loans:

- Down payment requirements. Jumbo loans tend to have stricter minimum down payment guidelines, often 20% or more of the loan amount. Conforming loans may be as low as 3% for first-time homebuyers.

- Private mortgage insurance (PMI). Jumbo loans almost always require private mortgage insurance, whereas conforming loans typically only require it if the down payment is less than 20%.

- Interest rates. Jumbo loans often come with higher interest rates than conforming loans due to the potential of higher risk involved for lenders.

- Loan limits. The main difference between these two types of loans is the loan limit. If the amount you’re looking to borrow exceeds the FHFA’s limit for your county, it’s a Jumbo loan.

- Closing costs and fees. Finally, closing costs and fees tend to be higher for Jumbo loans than conforming loans because they’re generally more complex and involve more work for the lender.

Jumbo Loan Qualifications Overview

While these conditions can vary somewhat depending on your area and a few other factors, here are some general guidelines for homebuyers looking to qualify for a Jumbo loan:

- Credit score. Credit and related requirements are typically higher for Jumbo loans than Conventional loans. In general, there tends to be a hard credit score minimum of 660, and many lenders may even require as high as 720 or 740.

- Debt-to-income (DTI) ratio. The maximum DTI for a Jumbo loan is typically around 43%, though this can vary depending on the specific lender. This means that no more than 43% of your income should be going towards debts each month.

- Documentation. Jumbo loans typically require extensive documentation, often including tax returns, bank statements, and asset verification. This is to ensure that you’re able to afford and repay the loan and aren’t taking on more debt than you can handle.

- Cash reserves. Another important factor that lenders will look at is your cash reserves. This is the amount of money you have left over after closing on a property that can be used to make mortgage payments if necessary. Lenders typically like to see at least six months’ worth of mortgage payments in cash reserves, though this can vary.

- Appraisals. In certain cases, not just one but two appraisals may be required for a Jumbo loan. This is to ensure that the property is worth at least as much as the loan amount and is yet another way for lenders to protect themselves from taking on too much risk.

As you can see, there’s a lot to think about if you’re looking to apply for a Jumbo mortgage. Make sure you understand all the requirements and are comfortable with any potential risks.

Considerations for Jumbo Loans

Jumbo loans may not be for everyone. There are a few potential reasons why someone may want to opt out of choosing a Jumbo loan and go with another option:

- You may not actually need a Jumbo loan. If you’re interested in a larger home but don’t need to borrow more than the conforming loan limit, it may not make sense to take out a Jumbo loan because you can end up paying more in interest and fees than necessary.

- You don’t qualify. As noted above, the lending criteria for Jumbo loans is typically stricter. If you don’t think you can meet them, it’s probably not worth your time to apply.

- The interest rates are high. Jumbo loan interest rates tend to be higher than conforming loan rates, so if you’re not comfortable with that you may want to look at other options.

Why Go Jumbo?

While there are important factors to consider, Jumbo loans can still be a great option for larger home purchases—especially in high-cost housing markets. Jumbo loans give qualified borrowers access to more expensive properties, including luxury estates, high-end condos, and prestigious neighborhoods. This expands the pool of available housing options, catering to diverse preferences and lifestyles. Additionally, Jumbo loans can often come with customizable terms and features tailored to the unique needs of high-net-worth individuals or savvy investors.

For more information on Jumbo loans, or to learn about any of our mortgage services, contact your local Supreme Lending team today.