Your Helpful Guide to Mortgage Homebuying Tips

Buying a home is one of life’s biggest milestones—a place to make lasting memories, build your future, and truly create a place to call your own. But let’s face it: the homebuying process can feel a bit overwhelming at first. But with the right preparation and guidance, you can navigate your mortgage smoothly and confidently. Whether you’re just thinking about purchasing a new home, buying for the very first time, or a seasoned pro, these 10 mortgage homebuying tips will help you make sense of the process and set you up for success.

1. Save for a Down Payment Early

One of the most important mortgage homebuying tips is saving for a down payment. While some loans may require as low as 3-5% down, the more you have saved, the better. A larger down payment also means a lower loan amount and reduced monthly payment. Working with your local lender early on in the process can help you plan for how much to save for.

2. Don’t Wait to Get Pre-Qualified

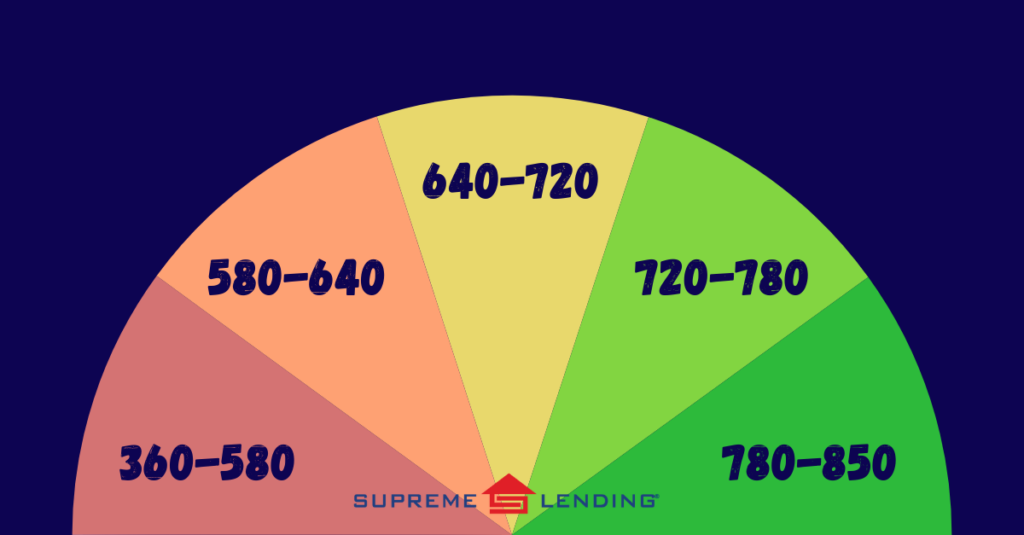

Before you even start house hunting, the first step in the homebuying process is getting pre-qualified for a mortgage. Pre-qualification gives you an initial idea of how much you may be able to afford based on information you provide to your lender, including your assets, income, and credit score. Getting a mortgage pre-qualification or pre-approval can also show sellers that you’re a serious, capable buyer.

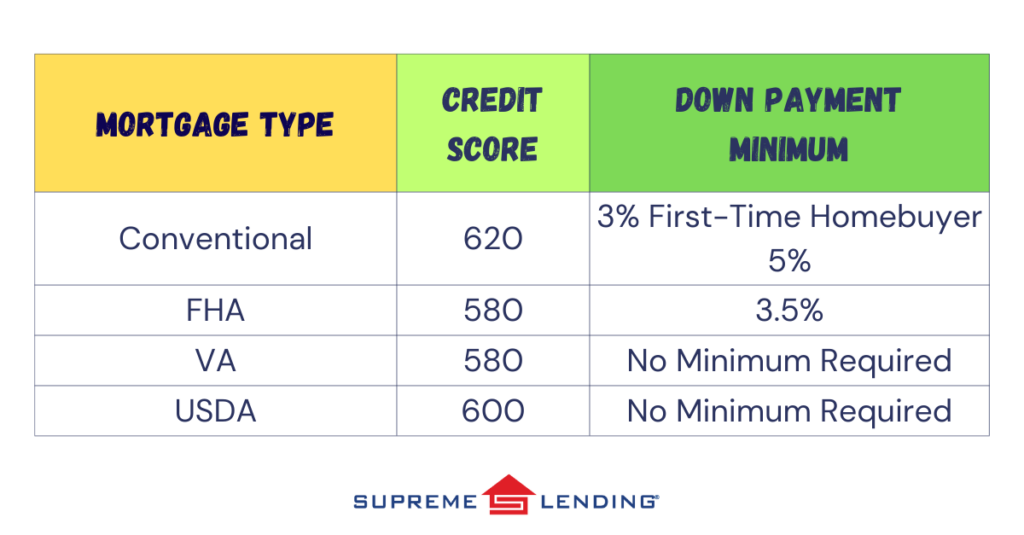

3. Compare Loan Types

Not all mortgages are the same, so it’s important to understand your options so that you can make an informed decision when it comes to financing your home. Whether it’s a Conventional, FHA, VA, or USDA loan, each comes with its own set of guidelines and down payment requirements. There are also several alternative financing programs including a jumbo loan, bank statement loan, and investment property loans.

4. Explore Down Payment Assistance Programs

Do you know about down payment assistance programs that may be available? These programs are designed to help more people become homeowners with affordable options and flexible guidelines. Depending on the program, assistance can be offered through grants, forgivable loans, deferred payment, or tax credits. Don’t hesitate to ask your lender about these potential opportunities, as they may make a big difference in your homebuying journey.

5. Have Your Documentation Ready

When it comes time to apply for your mortgage, you’ll need to provide a variety of documentation so that your lender can verify your income, employment, and creditworthiness. Common documents include pay stubs, tax returns, bank statements, and W-2s. Having these ready may help speed up the process and avoid delays.

6. Know What’s Included in Your Loan Estimate

After you apply for a mortgage, you’ll receive a Loan Estimate (LE). This document provides you with important information regarding your mortgage application, including the estimated principle payment, interest, taxes, and insurance—also known as your mortgage PITI.

7. Prioritize Both an Appraisal and Home Inspection

During the mortgage process, it’s crucial to understand the appraisal and home inspection—and why you should opt to do both. The appraisal is an assessment of the home’s value that most lenders require. This helps confirm that the loan amount aligns with the property’s market value. Meanwhile, the home inspection evaluates the property’s condition and systems. A home inspector can identify any potential repairs or issues, such as roofing damages, electrical problems, or structural concerns.

8. Avoid Large Purchases or New Credit

It’s also important to hold off on making any large purchases or opening new lines of credit during the mortgage approval process. Big expenses like buying a car or furniture, or applying for a new credit card, may affect your credit score and debt-to-income (DTI) ratio. To keep your loan approval on track, avoid major financial moves until after you’ve closed on your new home.

9. Understand Costs Beyond the Down Payment

While the down payment is a big part of the homebuying process, don’t forget about the additional costs involved in securing a mortgage. Beyond the down payment, you’ll need to consider closing costs, which are other fees to process the loan that typically range from 2-6% of the loan amount. Another potential expense is mortgage insurance, which is required for FHA loans and if your down payment is less than 20% for Conventional.

10. Review the Closing Disclosure

Before officially closing on your home, you’ll receive a mortgage Closing Disclosure (CD). This document provides a transparent summary of all loan details, including terms, projected payments, closing costs, and a transaction summary. Lenders are required to provide your disclosure no later than three days before your scheduled closing. Be sure to carefully review all information to ensure it’s correct to avoid any potential delays.

Supreme Lending Is Here to Help

As you can see, the homebuying process has a lot of moving parts. Keeping these mortgage homebuying tips in mind will help ensure your loan experience is a smooth one.

At Supreme Lending, we’re here to guide you every step of the way. Want to learn more about our mortgage services or ready to start your homebuying journey? Contact your local branch today!