by Supreme Lending | Aug 12, 2024

Unlocking Homeownership With Mortgage Gift Funds

When it comes to purchasing a home, the down payment is often a big hurdle for borrowers, especially first-time homebuyers. However, there may be an opportunity to help make homeownership a reality through mortgage gift funds. If you’re offered gift funds to use toward a home’s down payment or closing costs, it’s important to understand how the process works and what is needed. At Supreme Lending, we’re committed to guiding you through the mortgage process to achieve your dream of owning a home—that includes navigating gift funds.

What Are Mortgage Gift Funds?

Gift funds are sums of money given by family members, friends, or other eligible benefactors that can be used for the down payment or closing costs on a home purchase. These funds are a generous way for loved ones to help you invest in your homeownership journey without any expectation of repayment.

How Do Gift Funds Work?

Using gift funds for a mortgage is straightforward but requires adherence to certain rules to ensure they’re accepted by lenders. Here’s what you need to know:

- Documentation. The donor must provide a gift letter stating the amount of the gift, the relationship to the recipient, and that no repayment of the money is expected or required.

- Source Verification. Lenders will require proof of the donor’s ability to give the gift, often in the form of bank statements.

- Transfer Trail. It’s also crucial to provide documents verifying the transfer of funds from the donor to the borrower to satisfy lender requirements.

Lenders require these factors as confirmation that the gift isn’t in fact a loan, which would impact the borrower’s Loan-to-Value (LTV).

Guidelines for Loan Types

Depending on the type of loan you’re considering, there are specific guidelines to follow when using gift funds. These specify who may be eligible to provide the money and how much.

Conventional Loans

For conventional loans, gift funds may be used for some or all the down payment, closing costs, and financial reserves—as long as it’s from an acceptable source. The gift can be provided by a defined family member, including relatives by blood, marriage, adoption, legal guardianship, or domestic partner. The donor may not be or have an affiliation with the real estate agent, builder, developer, or any other interested party to the transaction.

Gift funds can be used for a primary residence and second home. Investment properties are not eligible. Minimum borrower contributions may apply depending on the down payment amount.

FHA Loans

Insured by the Federal Housing Administration, FHA loans offer a little more flexibility when it comes to mortgage gift funds. Donors can be family and other eligible givers such as a close friend, an employer or labor union, and charitable organization. A governmental agency or public entity that provides down payment assistance programs may also be eligible. However, cousins, nieces, and nephews are not qualified to provide gift funds for FHA.

VA and USDA Loans

While these government-insured loan options do not have down payment requirements, gift funds can still be used to cover closing costs. The gift can be provided by anyone that does not have an affiliation with the transaction. However, gift funds cannot be used to meet reserve requirements for VA and USDA loans.

Advantages of Mortgage Gift Funds

Ultimately, gift funds can help open doors to homeownership if you may not have qualified without the funds for a down payment or closing costs. Potential benefits of receiving gift funds include:

- Lower the financial burden of a down payment

- Improve your Loan-to-Value ratio

- May help you qualify for a more favorable mortgage

- Allow you to maintain savings for other expenses or emergency funds

Down Payment Assistance Alternatives

If you don’t have the option to receive gift funds, there may be other options to consider buying a home with less upfront costs. For example, FHA loans require a lower 3.5% down while VA and USDA loans offer no down payment requirement. For Conventional loans, eligible first-time homebuyers may put down just 3%.

There are also several down payment assistance programs designed to help more people achieve homeownership. Supreme Lending offers the Supreme Dream Down Payment Assistance that offers a fully forgivable second loan to cover the down payment and closing costs. There are also several local, regional, or state-specific programs available to provide aid. Eligibility typically depends on factors such as income, credit score, and location.

Our team at Supreme Lending believes that informed homebuyers make empowered homeowners. Understanding gift funds and alternatives for down payment assistance can help open doors to homeownership that might otherwise seem closed.

Ready to take the next step to buying a home? We’re here to guide you every step of the way. Contact your local branch to get started.

by Supreme Lending | Jul 29, 2024

If you’re thinking of buying a home, you may want to consider the possibility of seller concessions to help reduce upfront loan expenses. Imagine having a portion of your mortgage closing costs covered or even getting some essential home repairs taken care of without having to dig into your savings. That’s where seller concessions come in, also known as seller assistance. It can be a significant benefit for both buyers and sellers. In this guide, we’ll explore what seller concessions are, seller assist limits, and frequently asked questions.

What Are Seller Concessions?

Seller concessions are contributions paid by the seller that go toward the homebuyer’s closing costs. These can include closing fees, prepaid expenses, or even home repairs or improvements. These concessions can help lower the amount of money a buyer needs to bring to the closing table, making the home purchase more affordable.

The concession amount can be expressed as a percentage of the home’s purchase price or fixed dollar amount.

Examples of What Seller Concessions Can Cover

Seller concessions can be used for a variety of mortgage and homebuying costs including:

- Loan Origination Fees. Fees charged by the lender for processing the loan application.

- Appraisal Fees. This is the cost of having a home appraised.

- Home Inspection Fees. This is the cost of having a home inspected before closing.

- Property Taxes. Prepaid property taxes may be included in closing.

- Title Insurance. This insurance protects the buyer and lender from potential disputes over ownership.

- Discount Points. Also known as mortgage points, these help pay down the interest rate using upfront costs.

- Home Repairs or Improvements. Costs for necessary repairs identified during the home inspection or agreed-upon improvements before the sale.

How Do They Work?

- Negotiation. Seller concessions are typically negotiated as part of the buyer’s and seller’s purchase agreement. This request can be made with help from a real estate agent.

- Agreement. If the seller agrees to concessions, the specific details are outlined in the contract and must not exceed a specified limit depending on the loan type.

- Appraisal. The agreed-upon concessions cannot inflate the property’s value. Lenders require an appraisal to ensure the property’s market value supports the loan amount, including the concessions.

- Loan Approval. The lender will review the agreement and appraisal. This will ensure that the concessions align with the mortgage program’s guidelines.

- Closing. When the loan is ready to close, the costs are applied to the buyer’s closing costs or other agreed-upon expenses.

Who Benefits from Seller Concessions?

Both the buyers and sellers can benefit!

- Buyers. Concessions can lower the upfront costs needed to buy the home, making it easier to afford the property.

- Sellers. Offering concessions can also make the home more attractive for potential buyers, helping sell the home quicker.

Seller Assistance Limits

Limits on how much a seller can contribute vary depending on the loan type and down payment:

Conventional Loans

- Primary residence and second homes:

- 3% maximum with less than 10% down

- 6% maximum with 10-25% down

- 9% maximum with more than 25% down

- Investment properties:

- 2% maximum regardless of down payment

FHA/USDA Loans

- 6% maximum toward closing costs and prepaid items

VA Loans

- 4% maximum toward prepaid items

- No limit for closing costs or reasonable discount points

Frequently Asked Questions

Can the seller cover the entire down payment?

No. Seller concessions cannot be used for the full down payment. They are typically used for closing costs, prepaid expenses, and other associated fees, while meeting the loan guideline limits.

Does seller assistance affect the loan approval process?

Seller concessions themselves do not affect loan approval, but lenders can consider the impact on the Loan-to-Value (LTV) ratio and may require specific guidelines.

How does it impact the home appraisal?

The home’s appraisal must support the purchase price, including any seller contributions. If the appraised value is lower than the agreed-upon price, the lender may require adjustments.

Can a buyer negotiate for concessions?

Yes! Homebuyers can request this during negotiations. It’s essential to work with a knowledgeable real estate agent to help navigate the process.

How do seller concessions benefit first-time homebuyers?

First-time buyers often benefit from this as they may have limited funds for closing costs and other expenses. Seller assistance is another great way for more people to unlock the door to homeownership!

If you’re ready to start your homebuying journey, your local Supreme Lending team is ready to help! Contact us to learn about your mortgage options and get pre-qualified today.

by Supreme Lending | Jul 26, 2024

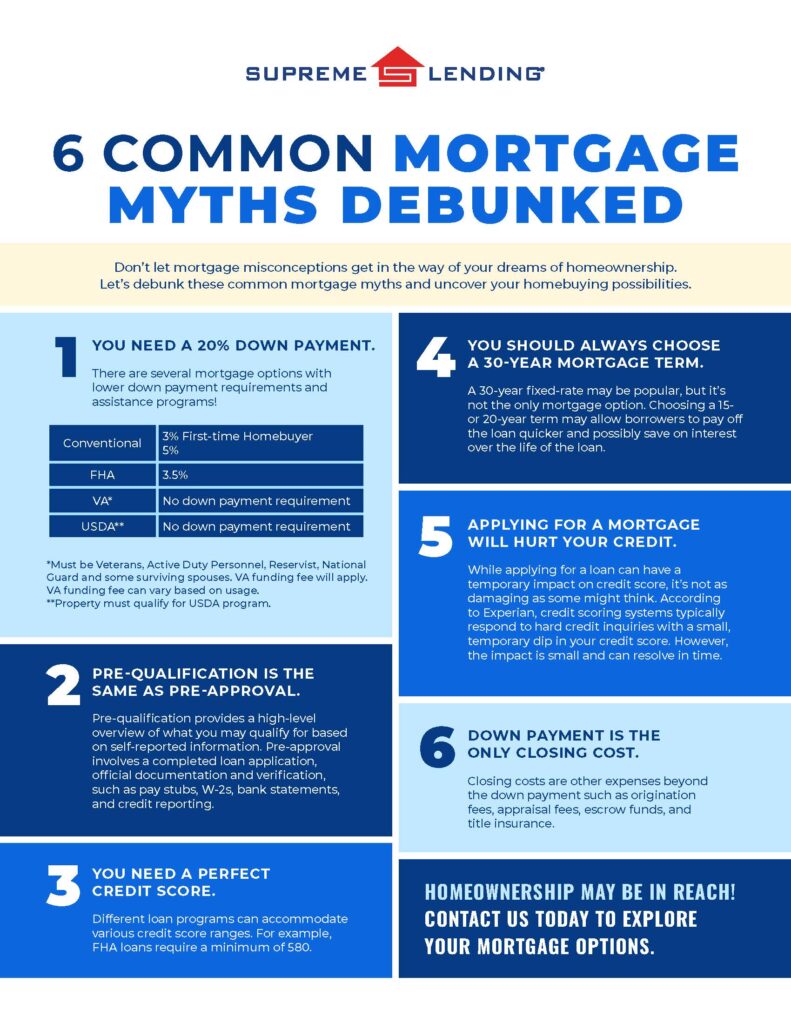

Don’t let mortgage myths get in the way of your dreams of homeownership. Unfortunately, there are several misconceptions about home financing that can make getting approved for a loan seem more difficult than it could be. Supreme Lending is here to set the record straight and help you navigate the steps of the mortgage process with the knowledge you need. Let’s debunk these six common mortgage myths and uncover your homebuying possibilities.

#1 Myth: You Need a 20% Down Payment.

Believing that you must have at least a 20% down payment saved up for a home may be one of the most common mortgage myths of all. When in fact, there are several loan options with lower down payment requirements.

For example, Conventional loans can require as low as 3% down for first-time homebuyers and 5% for repeat buyers. FHA loans require 3.5% down, serving as another affordable option. VA* and USDA** loans are unique in that they require zero down payment. There are also several down payment assistance programs for eligible homebuyers depending on various factors such as income or geographic location.

Why 20% Down?

The 20% myth may be misunderstood because of private mortgage insurance (PMI). If you don’t put down 20% for a Conventional loan, lenders will typically require you to have PMI, which is an added cost to your monthly mortgage payment. It’s important to note that if a borrower reaches a specified equity threshold in their home, mortgage insurance may be removed.

#2 Myth: Pre-Qualification Is the Same as Pre-Approval.

Nope. These terms are often used interchangeably but they are not the same when it comes to where you are in the loan process. Both provide an estimate of how much you may be able to afford for your monthly mortgage payments. However, the key difference between a mortgage pre-qualification and pre-approval is how lenders verify your information.

Pre-qualification is a high-level mortgage estimate based on self-reported information, such as income, debts, and assets. Plus, it’s oftentimes quicker to obtain.

On the other hand, a pre-approval takes a more detailed approach. This involves a completed loan application. Homebuyers must provide thorough documentation of financial history such as pay stubs, W-2s, and bank statements for verification. To get pre-approved, lenders will also verify your credit and employment.

#3 Myth: You Need a Perfect Credit Score.

A recent study found that people either don’t know or significantly overestimate the minimum credit score required for a typical mortgage, reported by Mortgage Professional America. While a higher credit score may help you secure more favorable mortgage rates or qualify for a higher loan amount, you don’t need to have flawless credit.

Different loan programs can accommodate various credit score ranges. For example, FHA loans are designed to make homeownership more accessible by accepting lower credit scores, a minimum requirement of 580.

#4 Myth: You Should Always Choose a 30-Year Mortgage Term.

A 30-year fixed-rate may be one of the most popular mortgages, but it’s not the only one to choose from. Depending on your situation or long-term goals, other mortgage terms may be a better fit. Whether it’s a 15-year term to pay the loan off quicker, or a 20-year term, Supreme Lending offers a wide range of options that can be tailored to match your needs.

#5 Myth: Applying for a Mortgage Will Hurt Your Credit.

While applying for a loan can have a temporary impact on your credit score, it’s not as damaging as some might think. When you apply for a new loan, lenders will pull your credit. This is also known has a hard inquiry for your credit report. According to Experian, credit scoring systems typically respond to hard credit inquiries with a slight, temporary dip in your credit score by a few points. However, the impact is small and can resolve in time.

Additionally, once approved for a mortgage, making on-time monthly payments may strengthen your credit in the long run.

#6 Myth: Down Payment Is the Only Closing Cost.

The down payment is a key part of closing a loan but isn’t the only cash you need to finalize your mortgage. Closing costs are other expenses beyond the down payment such as origination fees, appraisal fees, escrow funds, and title insurance. These costs will be outlined in the closing disclosure.

In addition, some lender programs allow borrowers to buy discount points to reduce their interest rate. This is essentially buying down the rate to save in interest over time. One discount point would equal 1% of the loan amount and would be included as a closing cost.

Understanding the Mortgage Process

Buying a home is one of the most significant purchases you can make. It’s crucial you’re properly informed about the loan process. By debunking these common mortgage myths, we hope to empower you with the knowledge needed to make informed decisions.

At Supreme Lending, we’re dedicated to providing personalized service and expert guidance throughout your homebuying journey. If you have any questions or want to explore your mortgage options, contact us today!

*Must be eligible Veterans, Active Duty Personnel, Reservist, National Guard, or qualifying surviving spouses. VA funding fee will apply. VA funding fee can vary based on usage.

**Property must qualify for USDA program.

by Supreme Lending | Jun 26, 2024

Understanding Down Payment Assistance Programs

When it comes to buying a home, one of the most common misunderstandings is that you need at least a 20% down payment. This misconception can discourage potential buyers, especially first-time homebuyers, from pursuing their dream of homeownership. Good news – there are several low and no down payment options, including down payment assistance programs, designed to help people become homeowners without hefty upfront costs. Discover what down payment assistance is, how it works, benefits, and other lower down payment mortgage options.

What Are Down Payment Assistance Programs?

Down payment assistance (DPA) refers to programs designed to provide financial aid to help cover part or all of the down payment and, in some cases, closing costs associated with purchasing a home. These programs can significantly reduce the upfront costs of buying a home and help more people across the country buy a home.

How Does Down Payment Assistance Work?

Down payment assistance programs are often provided by state and local governments, non-profit organizations, or other entities dedicated to promoting homeownership in local communities. DPA can come in various forms, such as grants, forgivable second loans, deferred payment loans, and tax credits. Down payment assistance programs can have specific guidelines, often targeted for first-time homebuyers and lower income areas.

- Grants. These are funds that do not need to be repaid. Essentially, they are a gift to help cover a home’s down payment.

- Forgivable Loans. When a loan is forgivable, a borrower doesn’t need to repay it after a certain time period and agreed upon criteria is met. For example, living in the primary home for a set number of years.

- Deferred Payment. This refers to loans that do not need to be repaid until the home is sold, the borrower refinances, or the mortgage is paid off.

- Tax Credits. Some down payment assistance programs offer mortgage credit certificates (MCCs) that provide a direct tax credit based on the interest paid on the loan.

Common Eligibility Requirements

While loans and down payment assistance vary by lenders and program guidelines, here’s an overview of some general eligibility criteria that may be considered.

- Income Limits. Many mortgage DPA programs have maximum income limits based on family size and location. Some lenders may consider how a borrower compares to the Area Median Income (AMI).

- Credit Score. Like most mortgages, credit score is a major factor. A minimum credit score is typically required, such as 620 for FHA and VA.

- First-time Homebuyers. Several down payment assistance programs are designed specifically for first-time homebuyers or people who haven’t owned a home within the past three years. Homebuyer education may also be included with the program as well.

- Primary Residence. In general, down payment assistance is used toward owner-occupied primary residences.

- Location. Properties may also need to be in a specific geographic area or within a targeted zone for revitalization to qualify.

- Profession. Some down payment assistance programs may also target specific occupations, such as first responders, educators, or healthcare providers. These options help give back to those who serve our communities.

Benefits of Down Payment Assistance

- Affordability. Evidently, down payment assistance can greatly reduce the amount of upfront costs when buying a home. When getting pre-qualified for a DPA program, you’ll be able to determine the right programs and potential savings.

- Increased Accessibility. Many people who might not have qualified for a traditional mortgage due to lack of savings, may qualify using down payment assistance. This helps open more doors to homeownership in your community.

- Flexibility. Down payment assistance typically can be combined with various loan types, including FHA, VA, and USDA. These typically already have lower down payment requirements to begin with. Work with an experienced, knowledgeable loan officer to discuss your options and understand what you may qualify for.

Types of Assistance

Local and State Bond Programs

Many local, regional, and state governments offer down payment assistance programs. Supreme Lending is proud to partner with these types of organizations to provide a wide range of DPA options across the country. Examples include statewide programs through the Texas State Affordable Housing Corporation (TSAHC) or California Housing Financing Agency (CalHFA), and more localized options, such as the Orange County Housing Finance Authority’s First-Time Homebuyer program.

Specialized Options

Fannie Mae and Freddie Mac also have down payment assistance options, such as HomeReady® and Home Possible® that offer down payment requirements as low as 3% for Conventional loans.

Supreme Lending’s Down Payment Assistance

Through Supreme Lending’s Supreme Dream 100% financing, no-money-down program, qualified borrowers get a 30-year fixed FHA loan, followed by a fully forgivable second loan to be used toward down payment, closing costs, and pre-paids. A unique feature of this program is that no income limits are required and it can be combined with a 2-1 temporary rate buydown.

Other Low Down Payment Mortgages to Consider

- FHA loans can require down payments as low as 3.5%.

- VA loans offer qualified military Veterans 100% financing, meaning zero down payment required.

- USDA loans, guaranteed by the U.S. Department of Agriculture, offer a zero down payment requirement for properties in eligible rural areas.

- Click here for an overview of common down payment requirements broken down by mortgage type.

At Supreme Lending, we’re always looking for innovative ways to help make homeownership more affordable. Whether it’s through local bond programs, low down payment loans, or our own Supreme Dream down payment assistance.

Contact us today to explore your mortgage options and down payment assistance programs.

by Supreme Lending | Mar 1, 2024

The men and women who have served in America’s Armed Forces have sacrificed so much to protect our freedom and communities, including time away from their families. There’s no profession more deserving of having a home to call their own. Supreme Lending is honored to provide opportunities to help Veterans and active military personnel achieve their dreams of homeownership through affordable mortgage options, including VA loans that can offer 100% financing. Let’s dive into the benefits and eligibility of VA loan programs.

Guaranteed by the U.S. Department of Veterans Affairs, VA loans are designed to help those who have served in the military and their eligible surviving spouses obtain homeownership with more flexible and favorable terms.

VA Loan Benefits

Two of the biggest benefits of VA loans are the no down payment or mortgage insurance premium requirements—making homeownership more accessible for those who may not qualify for a traditional loan. Other unique VA loan benefits and features include:

- Lower origination fees, appraisal fees, and closing costs.

- Purchase and refinance for primary homes.

- No prepayment penalties.

- Fixed- and adjustable-rate loan options available.

- Variety of eligible property types (single-family, townhomes, VA-approved condos, etc.).

- Available for qualified first-time and repeat homebuyers.

- 580 minimum credit score; 620 minimum credit score for loan amounts more than $ 766,550.

- At least 41% Debt-to-Income (DTI) ratio.

- VA non-allowable fees can be paid by seller, up to 4% of the loan amount.

- Two year waiting period after foreclosure or bankruptcy after discharged.

- Some states may offer additional options for extra affordability.

VA Loan Eligibility

A requirement of VA loans is that the homeowner lives in the home as their primary residence. A valid Certificate of Eligibility (COE) must be presented at the time of application, which includes military eligibility such as length of service or service commitment, duty status, and character of service.

VA Funding Fee

While there is no down payment requirement, VA loans do require a one-time funding fee to cover administrative or processing costs. The fee is 2.15% for first-time use of the program with zero down payment, still much lower than a traditional down payment! Additionally, the funding fee decreases to 1.5% with 5% or more down payment and to 1.25% with more than 10% down payment.

VA Loan Refinancing

Veterans Affairs also offers options for refinancing. A VA streamline refinance, also known as an Interest Rate Reduction Refinance Loan (IRRRL), could be a great option for military homeowners looking to potentially reduce their interest rate and monthly payments of a current VA loan. A VA cash-out refinance allows borrowers to leverage the equity they’ve built in their home and could help homeowners fund renovations or other large expenses.

For more information on VA loans and other mortgage options, reach out to your local Supreme Lending Loan Officer or contact us today.