by Supreme Lending | Nov 9, 2024

You’ve submitted your initial mortgage application, completed the necessary paperwork, and even had your home appraised. Now, you find yourself at the crucial stage of the loan process – underwriting. This is where the underwriter, acting as a gatekeeper for the lender, meticulously assesses your financial details to determine the risk of financing your home. In this article, we will explore the mortgage underwriting process, its significance, and what borrowers can expect during this critical phase.

Who Are Underwriters and What Do They Do?

Underwriters play a pivotal role in safeguarding the interests of the lender during the home loan process. Their primary responsibility is to assess your ability to repay the loan and evaluate the risk associated with lending money to you. They review various aspects of your financial profile, including your credit score, income, and the appraised value of the property. The goal is to ensure that borrowers are not taking on more mortgage responsibility than they may be able to handle.

Importance of Underwriting:

The housing crisis of 2008 highlighted the need for stricter underwriting guidelines. Loose regulations during that period allowed borrowers to access funds without adequate means to repay, resulting in widespread defaults. Today, underwriters adhere to stringent guidelines to help prevent the recurrence of such crises, protecting both borrowers and lenders alike.

What to Expect During the Underwriting Process:

Further Paperwork May Be Needed:

During the underwriting process, underwriters may request additional documentation to gain a comprehensive understanding of your financials. It’s crucial to provide any requested documents promptly to keep the mortgage process moving smoothly.

Turn-times Vary:

Depending on the loan type and market conditions, the underwriting process may take anywhere from 5 to 14 days. Understanding the potential timeline may help you manage expectations and plan accordingly.

Disclosure Mailings:

Borrowers may receive electronic or paper loan disclosures throughout the process. These disclosures are sent to ensure compliance with state and federal laws.

Loan Determinations:

After reviewing your application, the underwriter will issue one of three determinations:

Conditional Approval of Loan:

Your loan is cleared for funding, and your lender will discuss any remaining conditions specified by the underwriter. A closing date will be scheduled.

Suspension of Loan:

A suspension occurs when there are questions about a critical facet of your loan file. Your lender will work with you to identify and address any concerns, leading to a potential conditional approval.

Denial of Loan:

If your file indicates a high level of risk, the underwriter may deny the loan based on industry benchmarks, not personal intuition. For example, perhaps there was a significant drop in your credit score, indicating potential payment inconsistencies and a big risk for a lender.

What Happens If Your Loan Is Suspended or Denied?

Choosing the right lender is crucial, and at Supreme Lending, the relationship doesn’t end if your loan faces challenges. Supreme’s dedicated team may be able to help overcome underwriting objections, identify errors, and work with you to improve your application.

Understanding the mortgage underwriting process is vital for borrowers navigating the complex world of home loans. As you approach this final checkpoint, being prepared for potential requests for additional documents, varying turn times, and the possible outcomes of the underwriting review can help streamline the process. With Supreme Lending by your side, you can navigate the underwriting process with confidence and increase the chances of a successful loan closing.

Dos and Don’ts During the Mortgage Underwriting Process

The journey to homeownership involves various stages, and one of the most important steps is the mortgage underwriting process. This phase determines whether your loan will be approved or not. To ensure a smooth underwriting experience with Supreme Lending, it’s essential to follow a set of Do’s and Don’ts.

Do’s:

Maintain Consistent Debt Payments:

Make minimum monthly payments on your consumer debt until the loan closes. Any deviation from this may have adverse effects on your mortgage application.

Timely Mortgage Payments:

Ensure your mortgage payments are made on time and are no more than 15 days late. Any delay beyond this timeframe may pose risks to your loan approval.

Cooperate with the Title Company:

Respond to calls from the Title Company. Occasionally, there may be outdated or unreleased liens, which can complicate the ownership of your property. Addressing these issues promptly is vital for clearing your property’s title in preparation for closing.

Submit Requested Documents Promptly:

Provide any documents requested by Supreme Lending immediately. Timely submission is crucial, as documents can have expiration dates, and delays may affect your application.

Retain Financial Documents:

Hold onto electronic and paper copies of pay stubs, bank statements, and other financial documents until the loan closes. You may be required to provide them during the underwriting process.

Don’ts:

Avoid Job Changes or Retirement:

Refrain from resigning or retiring during the loan process without consulting your Supreme Lending mortgage expert. Changes in employment status may impact your loan approval.

No New Credit Accounts:

Do not open or apply for new credit accounts before your mortgage loan closes. New accounts or inquiries can be easily identified during underwriting and may jeopardize your application. Our experienced professionals understand that life happens, and should a need arise for situations such as applying for student loans or financing a child’s upcoming college tuition, we ask that you discuss your plans with a member of our team before you take action.

Avoid Balance Transfers:

Refrain from making balance transfers on existing credit card balances. Such actions may slow down the mortgage application process.

Don’t Pay Off Existing Credit Accounts in Full:

Avoid paying off existing consumer credit accounts (e.g. auto loans, credit cards, etc.) in full unless it aligns with the natural progression of making minimum monthly payments.

Successfully navigating the mortgage underwriting process requires careful attention to detail and adherence to specific guidelines. By following the Do’s and Don’ts outlined above, you may increase the likelihood of a smooth and successful loan approval. If you have any questions or concerns about your loan, don’t hesitate to reach out to the Supreme Lending team for assistance. Remember, open communication and timely action are key to a positive mortgage underwriting experience.

by Supreme Lending | Nov 7, 2024

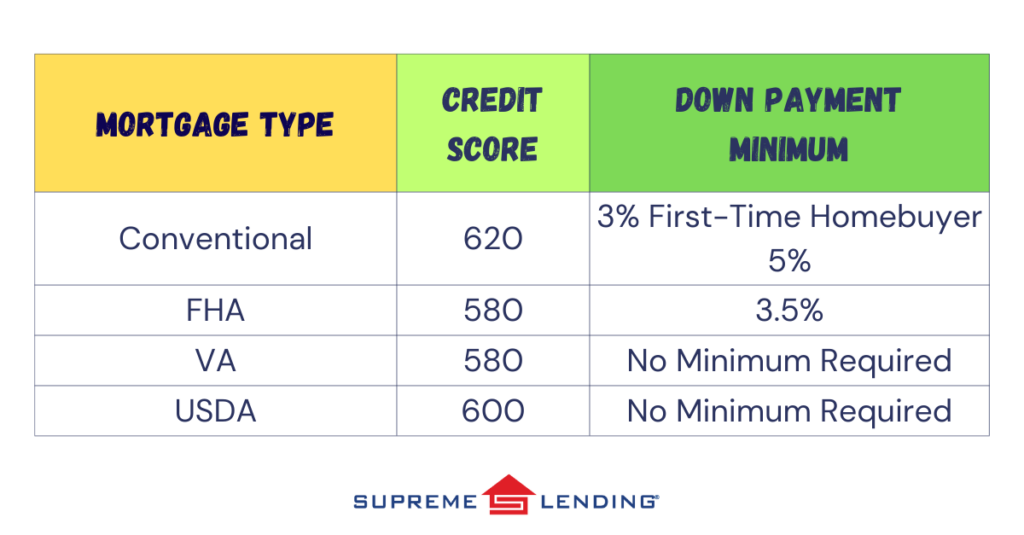

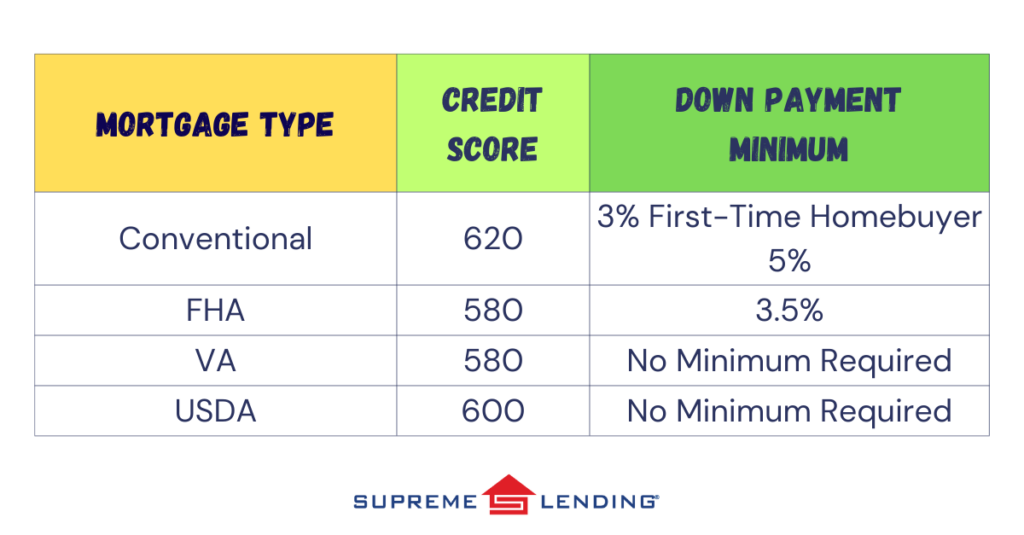

For aspiring homeowners and first-time buyers, many questions can arise about the mortgage process. What credit score do you need to qualify? How much down payment is required? Answers are based on several factors including the property, purchase price, and, most importantly, the mortgage type.

Here’s a breakdown to simplify the numbers and help you understand what you need to open the door to your dream home depending on common mortgage types:

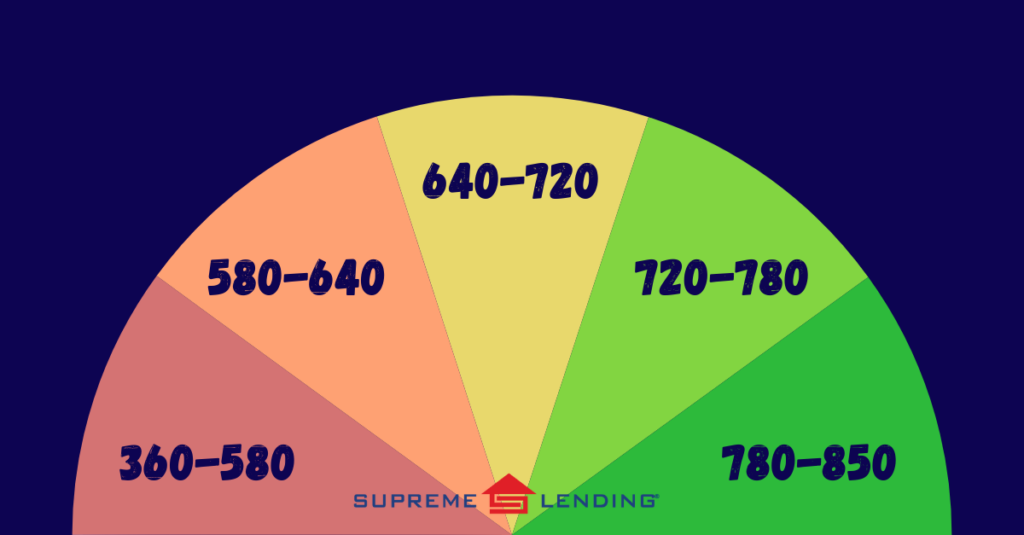

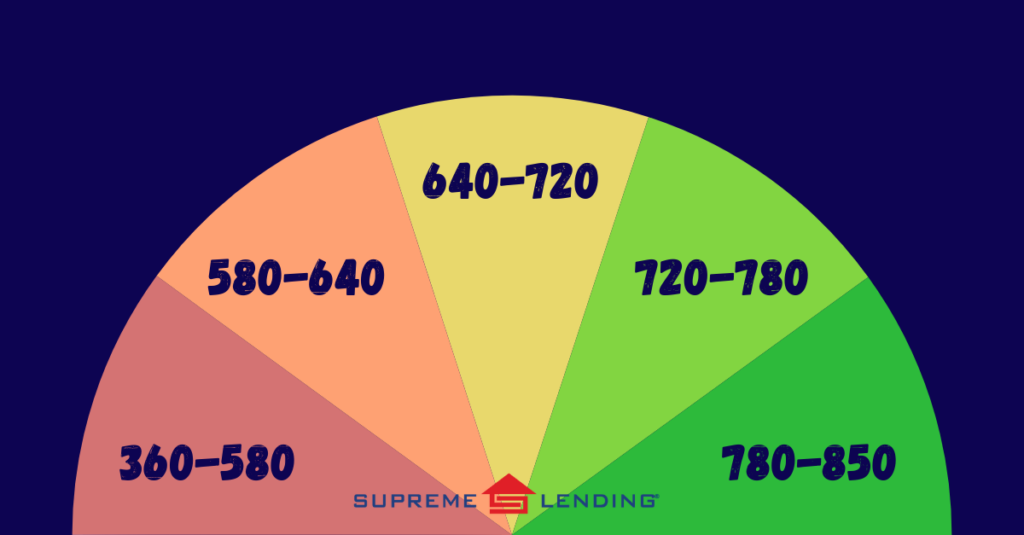

What Is a Credit Score?

Commonly determined by FICO® score, credit scores are calculated using the borrower’s financial background information such as payment history, credit utilization, length of credit history, types of credit in use, and recent credit behavior. The average credit score in the United States in 2023 was 715, according to Experian data.

Down Payment Assistance Options

If a homebuyer doesn’t have the required minimum down payment or would like to access more financing, Supreme Lending offers several down payment assistance options for qualified buyers. This can also help first-time buyers open the door to homeownership. Guidelines and eligibility vary depending on the program. For example, the Supreme Dream program offers down payment assistance in the form of a fully forgivable second loan and requires a minimum credit score of 620. Ask your Supreme Lending Loan Officer about qualified assistance programs.

Understanding credit score and down payment requirements for different types of mortgages is crucial for prospective homebuyers. While each loan type has its own guidelines, maintaining a good credit score and having sufficient funds for upfront costs at closing remains a common denominator for securing favorable terms and interest rates. By proactively managing your credit and staying informed about your options, you can navigate the mortgage process with confidence on your journey to homeownership.

Contact your local Supreme Lending branch to get pre-qualified and learn about your home financing options.

by Supreme Lending | Oct 17, 2024

Discover the Program Highlights of an FHA 203(k) Renovation Loan

Are you ready to turn a fixer-upper into your dream home? Whether it’s a home you’ve just bought or already own, renovation loans like the FHA 203(k) program may help you finance both the purchase and necessary repairs or updates all in one mortgage. Plus, the U.S. Department of Housing and Urban Development (HUD) announced that it is increasing the loan amount for Limited FHA 203(k) loans to $75,000 on all FHA case numbers effective November 4, 2024—that’s up from $35,000 which is huge news!

Here’s an in-depth look at how the FHA 203(k) renovation loan works, the differences between the Limited and Standard options, and what types of renovations may be covered.

What Is an FHA 203(k) Loan?

Insured by the Federal Housing Administration, the FHA 203(k) renovation loan allows homeowners to finance the cost of both the property and its renovations in a single loan. Whether you’re purchasing a home that needs updates or making repairs to your current home, this loan program may help make those dreams a reality. It offers the similar benefits of FHA loans for first-time buyers and repeat buyers alike. To qualify, eligible borrowers only need 3.5% down payment and there’s more lenient credit score requirements than other renovation loans.

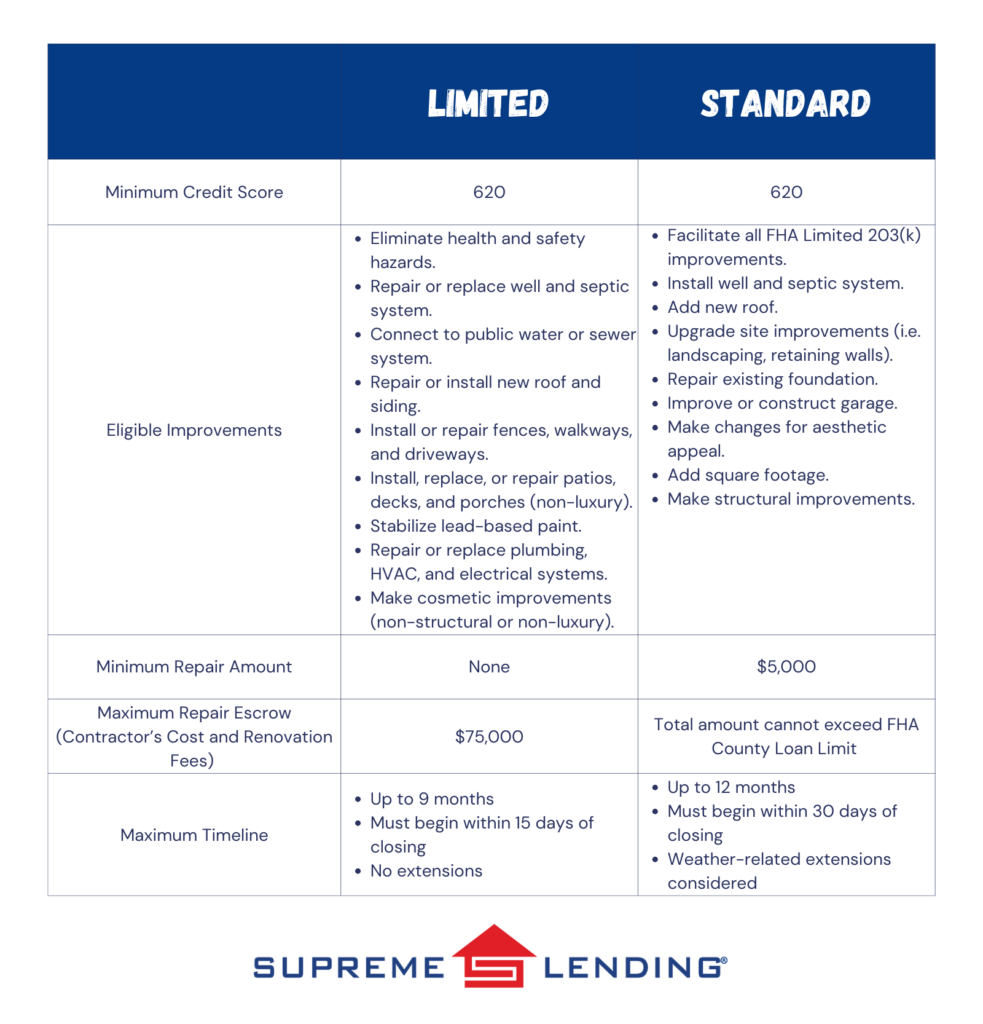

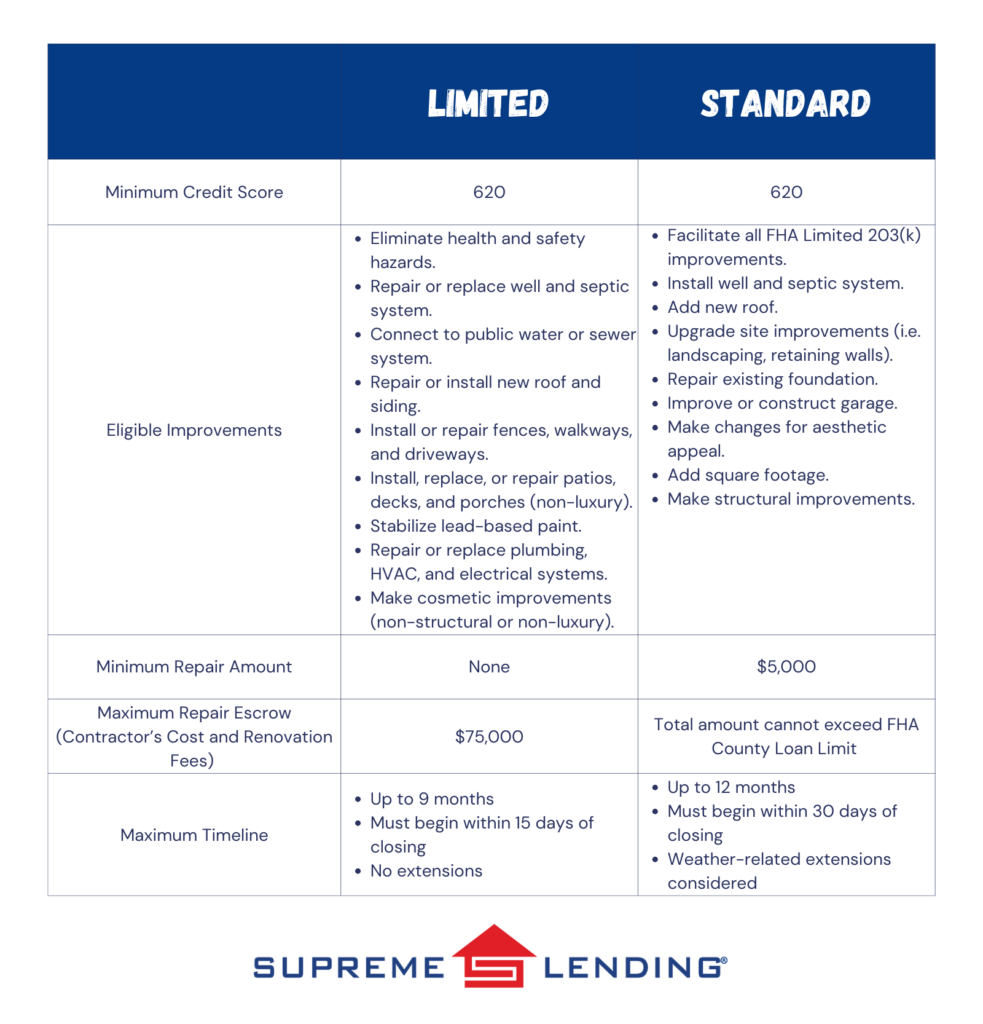

Limited vs. Standard FHA 203(k) Renovation Loan

There are two types of FHA 203(k) loans—Standard and Limited. Each has specific uses and limits depending on the scope of renovations you can make.

Limited FHA 203(k) Loan

The Limited 203(k) option is commonly used for smaller repairs and cosmetic upgrades. As mentioned, the loan amount will increase to $75,000 in November 2024, an exciting enhancement that will help open the door to renovations for more people. This loan covers non-structural projects such as remodeling kitchen fixtures, replacing flooring, painting, and minor landscaping. Unlike the Standard, the Limited program doesn’t require working with an HUD consultant or have a minimum loan amount.

Common Projects the Limited Covers

- Minor remodeling (i.e. updating kitchens or bathrooms)

- Replacing appliances or flooring

- Repainting or refinishing surfaces

- Energy-efficient improvements (i.e. installing new windows or insulation)

- Repairing roofs and gutters

Standard FHA 203(k) Loan

The Standard FHA 203(k) Renovation loan is more ideal for homes needing larger renovations and structural repairs. These may include adding rooms, replacing outdated plumbing or electrical systems, and fixing major structural issues. It has a minimum of $5,000 that must be used for renovations and the total loan amount must be within the FHA County Loan Limit. Because these projects are typically more complex, you’re required to work with an HUD-approved consultant.

Common Projects the Standard Covers

- Structural repairs or additions (i.e. adding on square footage or fixing foundation issues)

- Major systems replacements (i.e. plumbing, electrical, or HVAC systems)

- Roof repairs or replacements

- Modernization and improvements to the home’s function

- Accessibility improvements for people with disabilities

How Does the FHA 203(k) Renovation Loan Work?

The process for applying for an FHA 203(k) loan is similar to a regular FHA mortgage but comes with a few additional steps. Here’s an overview of how this loan program works.

- Find a property. Whether it’s a home you already own and want to refinance* or one you’re planning to purchase, identify a property that needs renovations.

- Get an appraisal. The home appraisal will assess both the home’s current market value as well as it’s “as-completed” value after the renovations are completed.

- Contractor and Estimates. Work with a licensed contractor to obtain the estimated costs for the repairs and improvements.

- Loan Application. You’ll apply for the loan based on the combined cost of the home and repairs.

- Renovation Timeline. Once the loan is approved, the renovation funds are placed into an escrow account and work begins. The renovation timeline can typically range from six months to one year.

*By refinancing an existing loan, total finance charges may be higher over the life of the loan.

FHA 203(k) Combined with FHA 203(h) Disaster Relief Loan

Did you know that eligible borrowers affected by federally declared disaster areas may be able to combine the FHA 203(k) renovation loan with the FHA 203(h) disaster relief loan? This means adding the renovation costs into a new mortgage if your home was destroyed and deemed unlivable. Plus, the damaged property is eligible regardless of the age of the home. It only needs to have been a habitable residence prior to the disaster.

Ready to Rebuild?

At Supreme Lending, we understand how important it is to transform a home into one that truly meets your needs. Whether you’re fixing up a new property or renovating your current home, the FHA 203(k) renovation loan offers an excellent way to finance those improvements. We’re proud to offer both Standard and Limited options to fit the scope of your home projects.

Want to learn more about FHA 203(k) renovation loans or other mortgage options? Contact our team at Supreme Lending today and get pre-qualified!

Looking for other renovation loan options? Read more:

by Supreme Lending | Feb 20, 2024

When it comes to buying a home, which could be one of the biggest investments you make, it’s important to understand your financing options. While a Conventional loan is more traditional, FHA loans have seen a rise in popularity due to more flexible guidelines. Let’s dive into a few of the FHA loan benefits and features for homebuyers to consider when choosing a mortgage.

What is an FHA loan?

The Federal Housing Administration (FHA) knows the tremendous value homeownership can bring to people’s lives and communities, which is why it was founded in 1934 to boost home sales and the economy. The government organization offers special mortgage insurance to lenders as an option to help more people who may not qualify for a Conventional or other type of home loan, qualify through an FHA loan.

When applying for a home loan, an FHA loan may be a practical option, especially if you:

- Are a first-time homebuyer.

- Have a lower credit score.

- Want a lower down payment.

- Are refinancing a high-cost mortgage.

FHA loan benefits and features include:

- Low down payment requirements with a minimum of 3.5%. Mortgage insurance is required.

- Credit scores as low as 580 may be accepted.

- Gift funds can be used for 100% of the down payment or closing costs.

- Fixed-rate and adjustable-rate mortgage options are available.

- Flexible qualification guidelines.

Now you might be asking, what properties are eligible for FHA loans? In addition to single family homes, FHA loans could also finance other qualified properties, such as 2- to 4-unit complexes and condos. Properties with an FHA loan will require an FHA appraisal to ensure the living space is safe and meets proper standards.

FHA loans could be a great option as a steppingstone into homeownership. Could these FHA loan benefits match your mortgage needs?

If you’re ready to see if an FHA loan or other home loan program is right for you, Supreme Lending is ready to help. Contact us to get started today!