by Supreme Lending | Dec 11, 2024

As winter creeps in and the temperatures start to dip, it’s time to get your home ready to take on the chill. Think of winterizing your home as more than just another seasonal chore—it’s a proactive move to save money, improve energy efficiency, and steer clear of those unexpected (and costly) cold-weather mishaps. A little preparation now means a cozier, more comfortable home all season long. Below are some tips for cold-weather preparedness to make sure your home is winter-ready.

Seal Gaps and Insulate

- Drafts may make your heating system work overtime, leading to higher energy bills. Sealing gaps with caulk around windows and doors prevents heat from escaping and keeps your home warmer during the cold months.

- Insulating your attic and walls helps maintain a steady indoor temperature, ensuring your home stays warm without overburdening your heating system. Proper insulation may reduce heating bills significantly.

- Adding weather-stripping around doors and windows creates a tighter seal, reducing heat loss and improving energy efficiency.

Service Your Heating System

- Before the cold weather hits, consider having a professional inspect and clean your furnace. An efficient furnace ensures your home stays warm and minimizes the risk of breakdowns in the middle of winter.

- Clean air filters are crucial for optimal air quality and system performance. Changing filters regularly helps your furnace run smoothly and prevents dust and debris from circulating in your home.

- Make sure your thermostat is calibrated properly! An incorrect reading may lead to uneven heating, leaving some rooms too cold or hot.

Protect Pipes from Freezing

- Pipes in unheated areas like basements or attics are more susceptible to freezing. Wrapping them in insulation sleeves may protect them from the cold, reducing the risk of burst pipes.

- On super cold nights, allow your faucets to drip slightly (especially if pipes run through an exterior wall). Moving water is less likely to freeze, and this small step may prevent major pipe damage.

- Check for gaps around pipes, especially near walls, windows, and floors. Sealing these gaps helps keep cold air from reaching vulnerable pipes.

Clean and Inspect the Chimney & Fireplace

- Schedule a chimney cleaning. If you have and plan on using your fireplace this winter, make sure your chimney is clean. Soot and debris may build up over time and pose a fire hazard. A professional chimney sweep will clear out the buildup, helping ensure safe use.

- Check your fireplace damper. A properly functioning damper ensures that heat doesn’t escape through the chimney. Make sure it opens and closes smoothly to regulate airflow and prevent drafts.

Inspect Roof and Gutters

- Clogged gutters may lead to ice dams, which may cause water damage to your roof and walls. Remove leaves and debris to allow water to flow freely and avoid any buildup of snow or ice.

- Winter storms may be hard on your roof. Inspect your roof for missing shingles or other signs of wear. Addressing any issues now may prevent leaks and other water damage down the line.

Prepare for Snow Removal

- Be ready for snow by keeping snow shovels, ice melt, and other snow removal tools on hand. Stocking up early may save you a headache when the snow starts falling. Don’t forget to use pet-safe ice melt if you have furry friends!

- Keep walkways and driveways clear to prevent slips and falls. Regular snow removal may help avoid ice buildup and keep your family and visitors safe.

Protect Your Home’s Exterior

- Disconnect hoses and cover outdoor faucets to protect them from freezing temperatures. This may prevent damage to your plumbing and reduce the risk of burst pipes.

- Heavy snow and ice that weigh down tree branches may potentially cause damage to your roof or other parts of your home. Trimming overhanging branches now may prevent potential issues later.

Review Insurance and Emergency Plans

- Ensure that your homeowner’s insurance covers winter-related damages, such as burst pipes or roof collapse due to heavy snow. Double-check before disaster strikes!

- Assemble an emergency kit with essentials like blankets, flashlights, batteries, a first-aid kit, and non-perishable food. Having these items on hand may be a lifesaver during winter power outages or other emergencies.

Conclusion

Winterizing your home may seem like a daunting task, but taking these steps ahead of time helps ensure that your home stays warm, safe, and efficient throughout those colder months.

We’re here to support you in every aspect of homeownership at Supreme Lending. Whether you’re exploring loan options for home improvements, considering refinancing* to free up funds for winter upgrades, or have general loan-related questions, our team is ready to assist. Let’s work together to make your homeownership journey as secure and comfortable as possible this winter. Reach out to us today!

*By refinancing an existing loan, total finance charges may be higher over the life of the loan.

by Supreme Lending | Apr 9, 2024

When considering buying a home and what your mortgage payment will look like, it’s important to be familiar with private mortgage insurance (PMI). All parties in the mortgage and homebuying process must be protected from certain risks, and this includes not only buyers and sellers, but also mortgage lenders. That’s where PMI comes in.

What exactly is private mortgage insurance, when is it required, what types are there, and when can it be removed? Here’s a breakdown of PMI and how it may impact your mortgage.

Private Mortgage Insurance Basics

PMI is an insurance that homebuyers are typically required to have when they pay less than 20 percent down payment for a home with a Conventional loan. The purpose of PMI is to protect the lender in case the borrower defaults on the loan and fails to make payments. This mitigates risk for the loan provider. If a property goes into foreclosure, PMI can reimburse the lender for a portion of their losses.

The cost for PMI is typically rolled into the monthly mortgage payment and funneled to the insurance provider—in the event the lender needs to make a claim.

It’s important to note that PMI is not homeowners insurance, which protects against things like fire damage or theft. PMI is required by lenders, and it only covers the lender in case of default. It’s not used to protect homebuyers’ interests. However, having PMI may allow borrowers to buy a home sooner than later, without having to save up for a larger down payment.

Types of PMI

While private mortgage insurance plans have the same goals, there are a few different ways to structure the PMI payments applied to a mortgage depending on specific circumstances or preferences. These options include:

- Buyer-Paid PMI: By far the most common type of PMI, buyer-paid private mortgage insurance involves the homebuyer or borrower paying a monthly insurance premium, which is added on to the monthly loan payment and paid to the insurance provider, though the charge can sometimes be rolled into the mortgage itself if applicable.

- Lender-Paid PMI: A much less common option is when the lender pays the monthly premiums, however as a result, the borrower would pay a higher interest rate to make up for the lender’s investment.

- Single-Premium PMI: This type of private mortgage insurance consists of the borrower paying for the full PMI policy upfront in a single lump sum, often at closing. Once this is paid, it eliminates monthly PMI payments.

- Split-Premium PMI: Borrowers may also have the option to combine the PMI payment options listed above by paying an upfront lump sum at closing that doesn’t cover the entire insurance policy, so a lower monthly premium is still required in addition to the mortgage payment.

Benefits of PMI

When lenders have the appropriate protections in place to provide loans, like requiring PMI in certain cases, they can offer mortgages to more families and individuals than if they were faced with taking on more risk.

Similar to how car insurance can protect both the owner of the car and the lender in case of an accident, private mortgage insurance is just another way to ensure that things go smoothly for all parties involved in a home loan. It gives more people the opportunity to buy homes with lower down payment options, while also making sure that lenders have protection against borrowers defaulting on their loans.

When PMI Is Required and How to Get Rid of It?

As noted above, the most common PMI requirement is when a homebuyer puts down less than 20 percent for a Conventional loan. However, this isn’t a set-in-stone rule. There can be loan programs with lower down payment requirements that may not require PMI. Always discuss with your loan officer to go over your qualified options.

Additionally, in most cases, PMI can be removed at some point during the life of the loan. Generally, once the borrower reaches 22 percent equity built in the home through things like paying down the mortgage or appreciation of the home’s value, PMI can be removed. This is done by request so if you think you may have reached this point, it’s important to contact your lender and ask about removal of the insurance. In other situations, PMI may automatically be removed once the homeowner reaches a certain agreed upon equity threshold.

For more on private mortgage insurance or to learn about other home loan programs, contact the team at Supreme Lending today.

by Supreme Lending | Mar 21, 2024

Picture this – you currently own or want to buy a home with good bones, but it needs some TLC. The good news is that you don’t have to handle a home remodel alone. Renovation loans are a great option to help fund home improvements, repairs, and enhancements by rolling the renovation costs into a single mortgage payment. It’s important to understand how renovation or home improvement loans work, types of renovation loan options, and benefits.

What Is a Renovation Loan?

Renovation loans are designed to help borrowers finance home improvement projects that will increase the value of the home. Whether you’re planning a small home makeover or extensive rehab project, a renovation loan combines a traditional purchase or refinance mortgage with the cost of renovations—it is an all-in-one mortgage financing option that covers the upfront costs of large repairs and projects.

Taking on the remodel before moving in can enhance your living space and home functionalities without the pressure of taking out an additional loan or paying out of pocket for costly repairs in the future.

Types of Renovation Loans

When it comes to renovation loans, there are a few options for prospective homebuyers and homeowners to consider based on eligibility, timing, and the scale of the home improvements needed.

FHA 203(k) Renovation

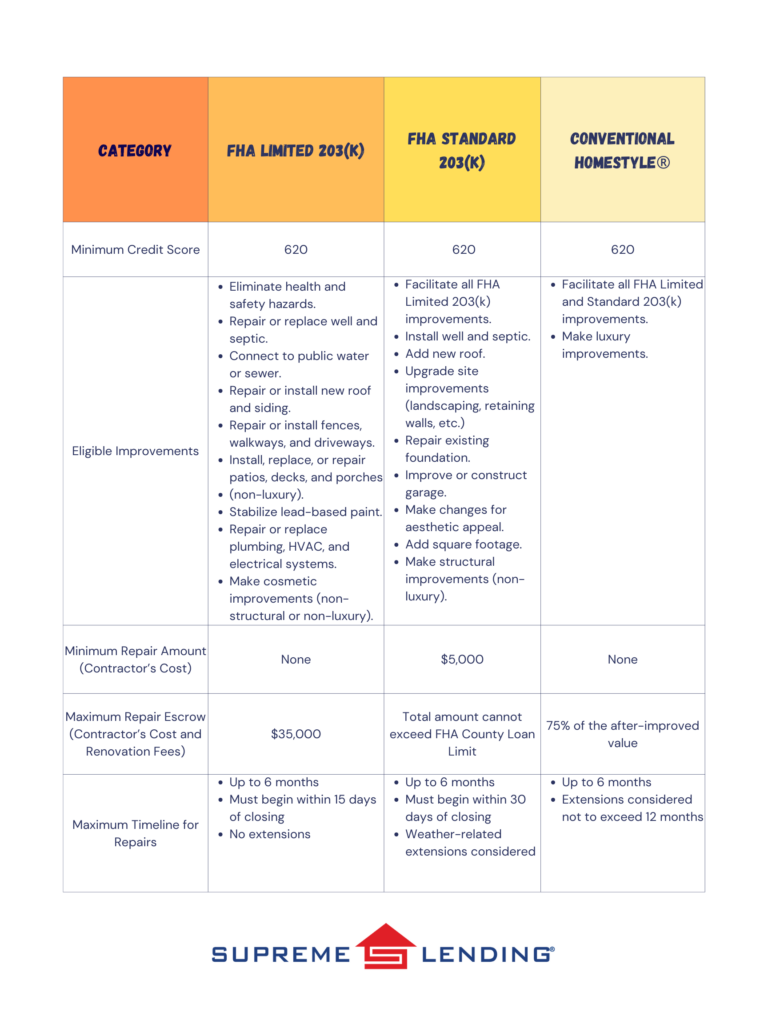

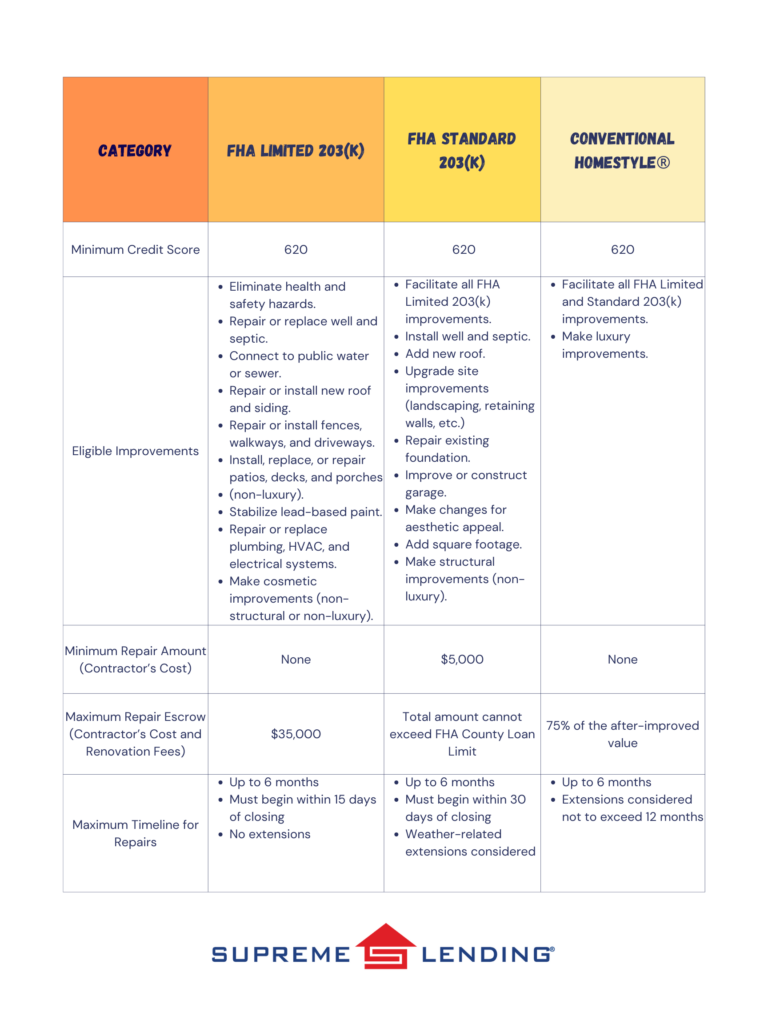

An FHA 203(k) loan, or an FHA rehab loan, is insured by the Federal Housing Administration and provides two options depending on the scope of the home improvement projects, including Limited 203(k) and Standard 203(k), offering different levels of renovation financing.

The minimum down payment for an FHA 203(k) loan is 3.5%. An FHA 203(k) loan covers common basic home improvements and repairs but excludes larger luxury projects and amenities. The Limited option has no minimum renovation amount and can cover up to $35,000 in renovation costs. The Standard has expanded eligible improvements including some structural upgrades and a minimum renovation cost of $5,000. Typically, all renovations must be completed within 6 months.

VA Renovation

The Department of Veterans Affairs (VA) also has a Renovation loan option. A VA Renovation loan offers 100% financing for eligible U.S. Veterans or military personnel to cover a mortgage combined with planned renovation costs into a single loan. Eligible home improvements are similar to FHA 203(k) to cover common upgrades that will make the property safer, healthier, or more functional, excluding luxury projects. VA Renovation loans can finance up to $50,000 in home repair costs.

Conventional Renovation

A Conventional Renovation loan, such as Fannie Mae’s HomeStyle® program, is another financing option that rolls the costs of home renovation projects into a single mortgage and offers more flexibility than a government loan. Conventional Renovation mortgages can cover larger, luxury upgrades, such as creating a high-end bathroom or kitchen with decorative tilework or adding a sparkling backyard pool. The maximum home repair amount is 75% of the home’s post-construction appraised value.

More Benefits of Renovation Loans and Remodeling

- Expand Your Home Search. Prospective homebuyers may have a broader range of properties to choose from, including fixer-uppers, knowing that they could finance custom home upgrades or needed repairs with a Renovation loan.

- Save on Upfront Costs. Home renovation projects can be costly. Funding home remodeling projects with your mortgage could help keep you from tapping into your personal savings and avoid hefty upfront repair costs.

- Grow Your Home Value. Renovation loans are intended to increase the value of your home, which may result in a smart, long-term investment and the potential to build more equity.

- Personalize Your Dream Home. Renovation loans offer an affordable option to help make your design visions come to life and beautify your home to fit your character.

- Enhance Comfort and Livability. Whether it’s expanding a kitchen, adding a bathroom, or creating a home office space, upgrading your home can add modern conveniences and improve your overall well-being.

If you’re looking to enhance your living spaces and potentially increase your property value, a Renovation loan could be the answer to creating the home of your dreams. To learn more about renovation financing or other mortgages, contact your local Supreme Lending branch today.

Related Articles: