by Supreme Lending | Nov 3, 2024

An Overview of Supreme Lending Credit Score Requirements

When you’re preparing to buy a home, understanding the mortgage credit score requirements is essential. Your credit plays a significant role in determining your eligibility for various loan programs, as well as interest rates you may qualify for. Our goal at Supreme Lending is to provide the smoothest mortgage experience possible, that includes guiding you with transparent information to help you to make an informed, confident decision. Here’s an overview of Supreme Lending’s credit score requirements for common loan programs and frequently asked questions.

Conventional Loans

Conventional loans are popular among homebuyers due to their flexibility and competitive interest rates. As a general rule of thumb, Supreme Lending requires a minimum credit score of 620 for Conventional loans. However, a higher score typically results in securing more favorable rates and terms.

FHA Loans

Insured by the Federal Housing Administration, FHA loans are another common mortgage option –especially for first-time homebuyers or borrowers with lower credit. These loans have more lenient credit score requirements, accepting as low as 580.

VA Loans

For eligible military Veterans and active-duty personnel, VA loans offer affordable options as they don’t require a down payment or mortgage insurance premiums. Like FHA loans, Supreme Lending’s credit score requirement for VA loans is a minimum of 580.

USDA Loans

Guaranteed by the U.S. Department of Agriculture, USDA loans provide affordable financing designed for homebuyers in designated rural areas with no down payment required. In general, Supreme Lending’s credit score requirement for this program is 600.

Jumbo Loans

Jumbo loans are used to purchase high-value properties with a loan amount greater than conforming loan limits, which is $766,550 for one-unit homes in 2024. Due to potential higher lending risk, Jumbo loans typically have stricter qualifications. Supreme Lending has jumbo programs with a minimum credit score of 680, but depending on the loan guidelines, some may require at least a 720 credit score or higher.

Frequently Asked Questions

Now that you have a snapshot of common credit score requirements at Supreme Lending, here’s some more insight on how your credit can impact your mortgage.

How is a credit score determined?

A credit score, often represented by a FICO® score, is a numerical assessment of a borrower’s financial health. It is calculated based on several key factors:

- Payment History: Your record of on-time payments versus late or missed payments.

- Credit Utilization: The amount of credit you’re using compared to your total credit limits.

- Length of Credit History: The duration of time you’ve had credit accounts open.

- Types of Credit in Use. The variety of credit accounts you have, such as credit cards, mortgages, and car loans.

- Recent Credit Behavior. This includes how many new credit accounts you’ve opened recently and credit inquiries.

Combining these factors provides a numerical score to help reflect your creditworthiness.

What qualifies as a generally “good” credit score?

In general, a credit score of 670 to 739 is considered good according to FICO® standards. Scores in this range suggest that you are a responsible borrower with a solid history of managing credit well. 740 or higher is considered very good or exceptional. Remember, a higher the credit score usually results in more favorable mortgage rates and terms.

Additionally, a credit score between 580 and 669 is considered fair. This range aligns with many of the credit score requirements outlined above depending on the loan type. So don’t fall victim to the common mortgage myth that you need perfect credit to qualify for a home loan.

What’s the difference between a soft credit pull and hard credit pull?

When applying for a mortgage, lenders need to pull your credit report. There are two ways to do this:

- A soft credit pull is a credit check that doesn’t affect your credit score. It’s typically used for pre-qualifications or when you check your own credit. Supreme Lending has this option when you get pre-qualified for a mortgage.

- A hard credit pull, on the other hand, occurs when a lender reviews your credit score as a formal credit application during the loan approval process. Hard pulls can temporarily lower your credit score by just a few points. However, there’s no significant impact, which is another mortgage myth to debunk.

Here to Help

Don’t navigate the mortgage process alone! Our experienced and knowledgeable team at Supreme Lending is here to help you understand all aspects of your homebuying journey. From understanding credit score requirements and determining which loan program may work for you to our seamless underwriting process, we help you close your loan with confidence.

Contact us today to get started!

Related articles:

Common Credit Score and Down Payment Requirements by Mortgage Type

FHA Loans vs. Conventional Mortgage: Which One Is Right for You?

by Supreme Lending | Jul 26, 2024

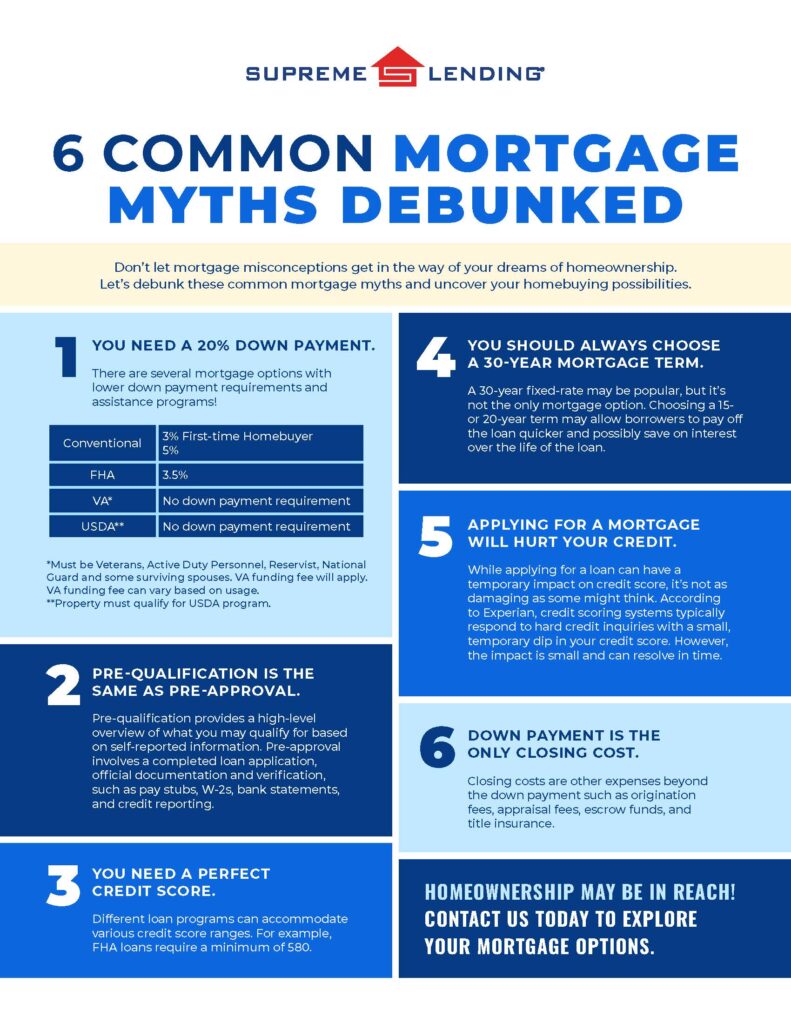

Don’t let mortgage myths get in the way of your dreams of homeownership. Unfortunately, there are several misconceptions about home financing that can make getting approved for a loan seem more difficult than it could be. Supreme Lending is here to set the record straight and help you navigate the steps of the mortgage process with the knowledge you need. Let’s debunk these six common mortgage myths and uncover your homebuying possibilities.

#1 Myth: You Need a 20% Down Payment.

Believing that you must have at least a 20% down payment saved up for a home may be one of the most common mortgage myths of all. When in fact, there are several loan options with lower down payment requirements.

For example, Conventional loans can require as low as 3% down for first-time homebuyers and 5% for repeat buyers. FHA loans require 3.5% down, serving as another affordable option. VA* and USDA** loans are unique in that they require zero down payment. There are also several down payment assistance programs for eligible homebuyers depending on various factors such as income or geographic location.

Why 20% Down?

The 20% myth may be misunderstood because of private mortgage insurance (PMI). If you don’t put down 20% for a Conventional loan, lenders will typically require you to have PMI, which is an added cost to your monthly mortgage payment. It’s important to note that if a borrower reaches a specified equity threshold in their home, mortgage insurance may be removed.

#2 Myth: Pre-Qualification Is the Same as Pre-Approval.

Nope. These terms are often used interchangeably but they are not the same when it comes to where you are in the loan process. Both provide an estimate of how much you may be able to afford for your monthly mortgage payments. However, the key difference between a mortgage pre-qualification and pre-approval is how lenders verify your information.

Pre-qualification is a high-level mortgage estimate based on self-reported information, such as income, debts, and assets. Plus, it’s oftentimes quicker to obtain.

On the other hand, a pre-approval takes a more detailed approach. This involves a completed loan application. Homebuyers must provide thorough documentation of financial history such as pay stubs, W-2s, and bank statements for verification. To get pre-approved, lenders will also verify your credit and employment.

#3 Myth: You Need a Perfect Credit Score.

A recent study found that people either don’t know or significantly overestimate the minimum credit score required for a typical mortgage, reported by Mortgage Professional America. While a higher credit score may help you secure more favorable mortgage rates or qualify for a higher loan amount, you don’t need to have flawless credit.

Different loan programs can accommodate various credit score ranges. For example, FHA loans are designed to make homeownership more accessible by accepting lower credit scores, a minimum requirement of 580.

#4 Myth: You Should Always Choose a 30-Year Mortgage Term.

A 30-year fixed-rate may be one of the most popular mortgages, but it’s not the only one to choose from. Depending on your situation or long-term goals, other mortgage terms may be a better fit. Whether it’s a 15-year term to pay the loan off quicker, or a 20-year term, Supreme Lending offers a wide range of options that can be tailored to match your needs.

#5 Myth: Applying for a Mortgage Will Hurt Your Credit.

While applying for a loan can have a temporary impact on your credit score, it’s not as damaging as some might think. When you apply for a new loan, lenders will pull your credit. This is also known has a hard inquiry for your credit report. According to Experian, credit scoring systems typically respond to hard credit inquiries with a slight, temporary dip in your credit score by a few points. However, the impact is small and can resolve in time.

Additionally, once approved for a mortgage, making on-time monthly payments may strengthen your credit in the long run.

#6 Myth: Down Payment Is the Only Closing Cost.

The down payment is a key part of closing a loan but isn’t the only cash you need to finalize your mortgage. Closing costs are other expenses beyond the down payment such as origination fees, appraisal fees, escrow funds, and title insurance. These costs will be outlined in the closing disclosure.

In addition, some lender programs allow borrowers to buy discount points to reduce their interest rate. This is essentially buying down the rate to save in interest over time. One discount point would equal 1% of the loan amount and would be included as a closing cost.

Understanding the Mortgage Process

Buying a home is one of the most significant purchases you can make. It’s crucial you’re properly informed about the loan process. By debunking these common mortgage myths, we hope to empower you with the knowledge needed to make informed decisions.

At Supreme Lending, we’re dedicated to providing personalized service and expert guidance throughout your homebuying journey. If you have any questions or want to explore your mortgage options, contact us today!

*Must be eligible Veterans, Active Duty Personnel, Reservist, National Guard, or qualifying surviving spouses. VA funding fee will apply. VA funding fee can vary based on usage.

**Property must qualify for USDA program.

by Supreme Lending | May 7, 2024

As the weather heats up, it may be the perfect time to consider the possibilities of buying a vacation home or second property. A vacation home can be for more than just a getaway, it’s an investment in relaxation, adventure, and cherished memories. But before you start packing for your own dream retreat, there are several things to consider when buying a vacation home – especially if it will be your second mortgage. Here are some helpful tips and considerations to get started on your journey to buying a vacation home:

Evaluate Your Financial Capacity

Buying a vacation home is a significant financial commitment, so it’s crucial to evaluate your finances and current capacity to take on another mortgage. Consider factors such as your income, existing debts, and credit score. It’s important to determine how much you could comfortably afford for a down payment, a second monthly mortgage payment, property taxes, insurance costs, and Homeowners Association (HOA) fees if applicable. Getting a mortgage pre-qualification or pre-approval can help provide an estimate of potential home financing costs you’re able to cover.

Understand Mortgage Requirements

Mortgage requirements for buying a vacation home can differ than a primary residence. Lenders may have stricter criteria for second homes, including higher down payment requirements and interest rates. Work with experienced mortgage professionals, like the team at Supreme Lending, to help guide you through your vacation home financing process.

Explore Home Loan Options

There are several types of loan programs to be aware of when purchasing a vacation home. Conventional, FHA, VA, or jumbo loans are common options. Depending on the property type, there are also more alternative financing to consider, such as warrantable and non-warrantable condo loans or Debt Service Coverage Ratio (DSCR) if the property will generate rental income.

Factor in Additional Costs

Owning a vacation home comes with more costs beyond the mortgage payments. Consider how much it will cost to adequately furnish the property and any appliances you may need. There are also monthly utilities and on-going maintenance and repairs to keep in mind. If your vacation home has a lush yard or sparkling pool, lawn and pool services may be needed as well.

Choose the Right Location

Location, location, location! It’s key when buying the vacation home of your dreams. Research desired destinations and convenient neighborhoods. Consider factors such as proximity to amenities, attractions, and outdoor activities you may enjoy. Whether it’s your tropical beach escape, serene cabin in the mountains, or high-rise in a popular city, planning a strategic location could help determine how you use the property and influence potential rental income.

Discover Rental Opportunities

If you’re considering renting out your vacation home when you’re not using it, research the rental potential in the area. Look into rental demand, occupancy rates, rental prices, and any possible local regulations or restrictions on short-term rentals. Working with a property management company can help streamline the rental process and maximize rental income.

Plan for Property Management

Owning a vacation home requires ongoing maintenance and management, even when you’re not there. Consider how you’ll handle tasks such as landscaping, cleaning, repairs, and security. If you’re not able to manage these responsibilities yourself, you could budget for hiring a property management company to handle them on your behalf.

Consult with Experts

Navigating the process of buying a vacation home can be complex, so don’t hesitate to seek guidance from local real estate agents who know your preferred location, an experienced mortgage lender like Supreme Lending, and other financial advisors or legal professionals. They can provide valuable insights and expertise to help you make informed decisions and avoid potential pitfalls along the way.

Enjoy the Benefits

Despite the considerations and added responsibilities involved, buying a vacation home can be incredibly rewarding. It provides a place to escape, relax, and create lasting memories with family and friends. With careful planning and the right guidance, buying and owning a vacation home can be the key to unlocking your own personal paradise.

While owning a vacation home is an exciting opportunity, it’s essential to approach the process thoroughly and strategically. The team at Supreme Lending is ready to help make your dream of buying a vacation home a reality – your paradise awaits!

by Supreme Lending | May 7, 2024

So, you’ve decided to take the plunge into homeownership. Congratulations! But where do you start? The mortgage process may seem overwhelming, especially for first-time buyers. That’s where your local Supreme Lending team comes in to help simplify the journey from pre-qualification to closing, resulting in a smooth and seamless experience. Let’s break down the nine basic steps of the mortgage process and see how Supreme Lending can help you every step of the way.

1. Get Pre-Qualified.

When buying a home, it’s crucial to know how much house you can afford. Getting pre-qualified or pre-approved for a mortgage is a great first step to becoming a homeowner. A pre-qualification will provide an estimate on what you may be able to qualify for based on information you provide such as assets, income, and credit. Your lender can even provide a pre-qualification letter, which can help show sellers that you’re a capable and serious buyer.

2. House Hunting.

Let the house hunting begin! Work with a real estate agent and view properties based on your location, style, and budget. At Supreme Lending, we understand that finding the perfect home is about more than just the numbers. That’s why we want to ensure your mortgage aligns with your dream home.

3. Make an Offer and Negotiate.

Found your dream home? Now it’s time to make an offer and negotiate a contract based on agreed upon price and terms. With Supreme Lending by your side, you can approach negotiations confidently, knowing that we’re here to support you through all the steps of the mortgage process.

4. Complete a Full Loan Application.

Once your offer is accepted, it’s time to move forward and complete the full mortgage application process by notifying your lender of your intent to proceed with the loan. Supreme Lending can then help guide you through this important step and help you gather the necessary financial documents required, such as pay stubs, tax returns, and account statements.

5. Review the Loan Estimate.

Understanding the details of your loan is essential. During this step, Supreme Lending will provide you with a comprehensive Loan Estimate (LE) document, that breaks down initial disclosures and transaction terms, such as interest rate, closing costs, and any other applicable information. Carefully take the time to review and ensure you fully understand your loan before moving forward.

6. Property and Title Evaluation.

Before finalizing the deal, it’s essential to ensure the home is in good condition and ready to be moved in to. An appraisal is ordered to determine the home’s market value, an inspection is completed to confirm that the home’s systems are up to code, and a title search is conducted to confirm a clear transfer of ownership. Finalizing these important assessments is paramount for a smooth closing.

7. Underwriting Review.

Your loan application undergoes a detailed underwriting review to ensure all lending guidelines are met. Additional conditions may be requested for final approval. With Supreme Lending’s expertise, you can trust that your application is in good hands. Our in-house underwriting team works diligently to streamline the process, keeping you informed every step of the way.

8. Clear-to-Close and Final Review.

Once your loan is approved and all conditions are met, you’re issued the three most exciting words throughout the steps of the mortgage process: Clear-to-Close! You’ll receive an official Closing Disclosure (CD) at least three days prior to your closing day to review. Once you sign off, the final documents are prepared and confirmed.

9. Closing Time.

The big day has arrived! With Supreme Lending, you can sign your closing documents with confidence, knowing that everything has been accurately reviewed and ready to transfer the funds and ownership. Finally, you receive the keys to your new home, marking the end of your journey to homeownership and the start of an exciting new chapter.

While the path to homeownership may seem daunting at first, with Supreme Lending, it becomes an exciting and rewarding experience. From pre-qualification to closing, we can provide the expertise, support, and personalized service you need to navigate the steps of the mortgage process with ease.

So, what are you waiting for? Contact your local Supreme Lending branch today to get started.

by Supreme Lending | Mar 15, 2024

When considering buying a home, it’s highly recommended that the first step in your homeownership journey is to work with a lender to get pre-qualified or pre-approved for a mortgage. While the two terms sound similar and both help give buyers an understanding of how much they may qualify for a loan, there are distinctions between getting a mortgage pre-qualification and pre-approval. Let’s dive into the differences between these crucial first steps and benefits of each in your homebuying experience.

Mortgage Pre-Qualification: A Preliminary Evaluation

Pre-qualification is an early step in the homebuying and mortgage process. It offers buyers and lenders alike a high-level snapshot of a borrower’s finances and potential buying power. When getting pre-qualified, lenders will typically collect basic financial information provided by the buyer, including income, debts, assets, and any amount of savings or cash they may have available for a down payment. It’s a valuable starting point, giving you an idea of your budget before you start house hunting.

During the pre-qualification process, borrowers may be able to opt for a soft pull credit inquiry. This means your information would remain confidential, with no impact on your credit score and avoids unwanted credit solicitations and third-party trigger lead calls. Ask your loan officer about your credit reporting options.

While a mortgage pre-qualification is less detailed than a pre-approval, this step can be quicker and involves less documents to help busy homebuyers hit the ground running and start their home search. A pre-qualification letter can also show sellers your interest in buying a home and that you can afford an estimated mortgage.

Mortgage Pre-Approval: A Deeper Dive

A mortgage pre-approval takes a more detailed approach and provides an even clearer, more accurate picture of a borrower’s finances and capacity for a mortgage. This is because the loan estimate is based on validated details.

In this step, prospective homebuyers will need to provide their lender with thorough documentation of their financial history for verification, including records like pay stubs, tax returns, and bank statements. Lenders will also run the borrower’s credit score and verification of employment if applicable.

Once pre-approved, the borrower will receive the estimated loan amount they may qualify for based on the verified information—verified being the key differentiator between a pre-approval and a pre-qualification. A pre-approval also gives you, the buyer, a more competitive edge because it demonstrates to sellers that you’re serious and eager to buy a home.

Other Reasons to Get Pre-Qualified or Pre-Approved

- Determine Affordability. It gives you an idea of how much you can afford based on your credit, income, debt, and potential down payment funds. This will help guide your home search within your budget.

- Understand Monthly Payments. With the estimated loan amount you can qualify for, you can get a breakdown of your monthly principal, interest, taxes, and insurance costs to help set expectations for planning your mortgage.

- Find the Right Loan Program. Evaluating your financial details and knowing how much you can qualify for can also help you determine the loan type best fit for your needs and if you could benefit from programs such as first-time homebuyer or down payment assistance.

- Strengthen Your Offer. As mentioned, having a pre-qualification or pre-approval can show sellers you’re a credible buyer and strengthen your offer on a home, which is especially helpful in a competitive market.

- Save Time. Being prepared in advance with a pre-qualification or pre-approval helps identify and avoid any potential roadblocks that could arise during the mortgage process, setting you up for a smooth closing.

In conclusion, getting a mortgage pre-qualification or pre-approval offers invaluable knowledge and opportunities in your homebuying journey. Ready to take the first step? Our Supreme Lending loan officers are ready to serve you! Contact your local branch today.