by Supreme Lending | Nov 19, 2024

Refinancing* your mortgage may be a strategic financial move that may unlock potential savings, but a common question for homeowners is, how soon can you refinance? Timing is everything. Whether you’re looking to lower your monthly mortgage payments, pay off your home loan quicker, or tap into your home equity for extra cash, knowing when to refinance is important. Let’s dive into the basics of refinancing, how soon you can refinance depending on the loan type, and how to determine the ideal time to consider the option.

Understanding the Basics of Refinancing

Refinancing involves taking out a new mortgage with different terms and using it to pay off your existing loan. The process may result in various benefits:

- Lower Interest Rates. If market conditions cause rates to drop since you purchased your original home loan, refinancing at a lower rate may lead to significant savings over the life of the loan.

- Reduce Monthly Payments. Securing a lower interest rate or a longer loan term may also decrease your monthly mortgage payments.

- Shorter Loan Term. If you can pay off your mortgage much sooner due to an increase in income, for example, it may make sense to refinance into a shorter term.

- Switch Loan Type. If you initially choose an Adjustable-Rate Mortgage, also known as an ARM loan, you may be able to refinance into a fixed-rate loan before the ARM rate adjusts. This may save you interest costs in the long run.

- Cash Out on Your Equity. When refinancing, you might opt for a cash-out refi loan. This allows you to tap into your equity, which is the portion of your home’s value that is yours.

- Payoff Higher-Interest Debts. You can use the cash from your equity to pay other debts such as high-interest credit cards, car loans, or student loans.

- Eliminate Private Mortgage Insurance. In some cases, you may have to pay a monthly fee for mortgage insurance. Once you reach a certain equity threshold, some lenders allow you to remove the private mortgage insurance by refinancing.

Timing Guidelines Based on Loan Type

The timing for when you can refinance your home depends on the lender and type of loan. It’s common for mortgage refinances to require a waiting period, or a seasoning period. Here are some general guidelines on how soon you can refinance a mortgage:

Conventional Loans

For conventional loans, most lenders require at least six months from your original closing date before you can refinance. This waiting period allows lenders to assess your payment history and ensure that you’re not a high-risk borrower. If you use another lender to refinance, you may be able to do a rate-and-term refinance without a seasoning period.

FHA Loans

For FHA loans, which are insured by the U.S. government’s Federal Housing Administration (FHA), you may be able to get an FHA Streamline Refinance. This simplifies the process and requires less documentation. However, you can’t get a streamline refinance until after 210 days from the closing date. You must also have made at least six months of on-time payments.

VA Loans

Similar to FHA, VA loans also offer a streamlined refinancing option known as an Interest Rate Reduction Refinance Loan (IRRRL). You’ll have to wait 210 days from the closing date of your existing VA loan and make six consecutive on-time payments to be eligible.

USDA Loans

These types of loans for rural areas are similar to those of FHA and VA loans. You’ll typically need to wait for 180 days or 12 months (depending on the type of refinancing) and establish a history of making on-time payments for the past six months to one year depending on the program.

Cash-Out Refi Loans

Additionally, how soon can you refinance with a cash-out refi? For this option, you typically need to have occupied the home as a primary residence for at least 12 months.

Why Timing Matters

Prepayment Penalties and Other Fees

A mortgage prepayment penalty is a fee charged by lenders if you pay off your mortgage early. Essentially, this helps compensate lenders for the interest income they lose when the loan is paid off early. When refinancing, it’s important to know if your current mortgage has a penalty or other fees associated to paying off the loan early. The cost of the fee may outweigh the benefits of refinancing.

Down Payment Assistance

Additionally, if you used down payment assistance for your current mortgage, check the terms of that aid. For some programs, refinancing too soon might require you to repay the assistance amount. Other programs may even require repayment of the down payment assistance amount when you refinance regardless of how long you’ve had the loan. This could impact any potential savings from refinancing.

Best Practices and Considerations

When deciding whether it’s a good time to refinance, here are a few things to keep in mind:

- Interest Rates. Monitor the rate and market trends if your primary goal is to refinance with a lower interest rate. You can always reach out to your local loan officer at Supreme Lending to help determine what your potential refinance rate may be.

- Closing Costs. Just like a traditional mortgage, refinancing includes closing costs that can range from 2% to 6% of the loan amount. Be prepared so you’re not surprised at the closing table.

- Break-even Point. Calculate the break-even point by determining when the costs of refinancing will be outweighed by the potential savings. Basically, it’s when your investment in refinancing will start to pay off.

- Loan Term. Consider whether you want to shorten your loan term to save on interest over the life of the loan or extend it for potentially lower monthly payments.

- Credit Score. A stronger credit score may qualify you for more favorable rates, so it’s worth monitoring your credit and making regular, on-time payments.

- Financial Goals. One of the most important aspects of refinancing is to make sure that a refinance aligns with your short- and long-term financial goals. Are you looking to minimize other debts, invest in renovations, or change your loan type?

Is Now the Right Time to Refi?

So how soon can you refinance your mortgage? Ultimately, it comes down to the loan-specific guidelines and your personal financial goals. It’s essential that you are well-informed, understand the refinancing process, and know all the factors that will go into your new refinanced loan. At Supreme Lending, we’re committed to helping you navigate your refinancing journey with ease and confidence.

*By refinancing an existing loan, total finance charges may be higher over the life of the loan.

by Supreme Lending | Nov 7, 2024

For aspiring homeowners and first-time buyers, many questions can arise about the mortgage process. What credit score do you need to qualify? How much down payment is required? Answers are based on several factors including the property, purchase price, and, most importantly, the mortgage type.

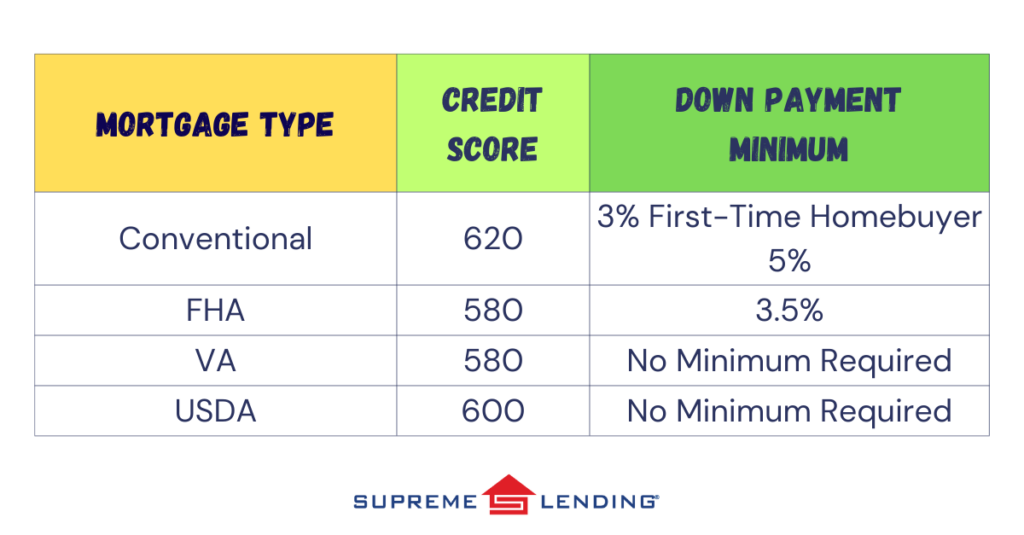

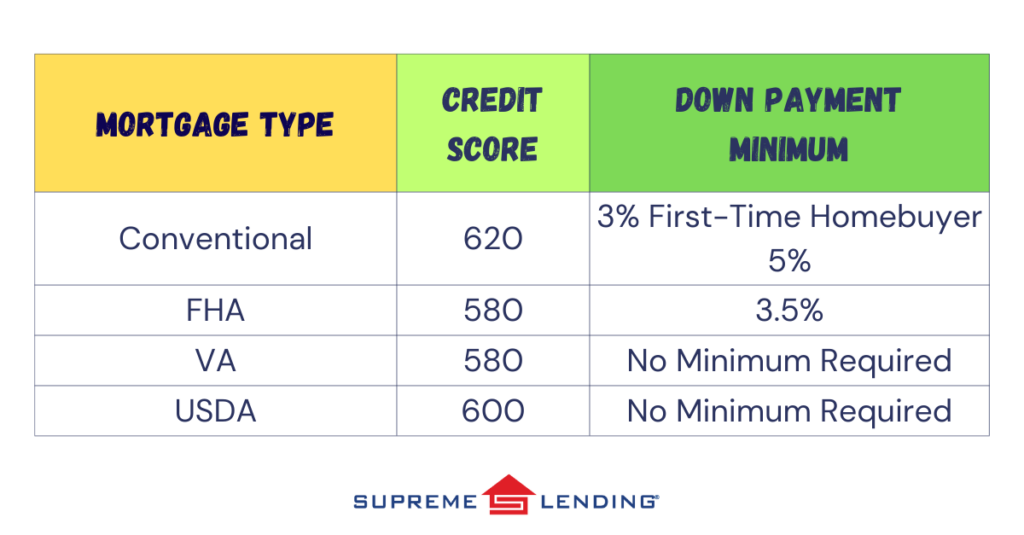

Here’s a breakdown to simplify the numbers and help you understand what you need to open the door to your dream home depending on common mortgage types:

What Is a Credit Score?

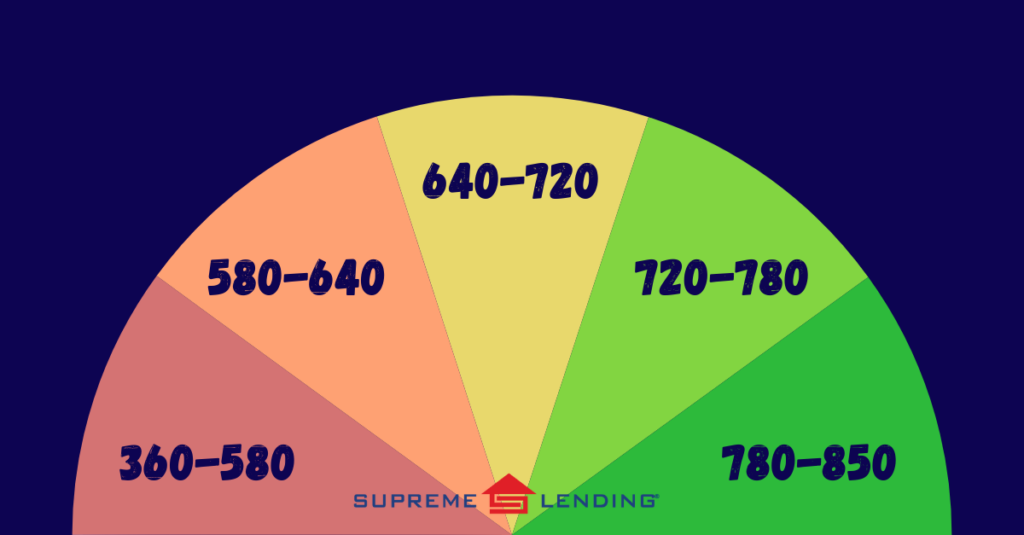

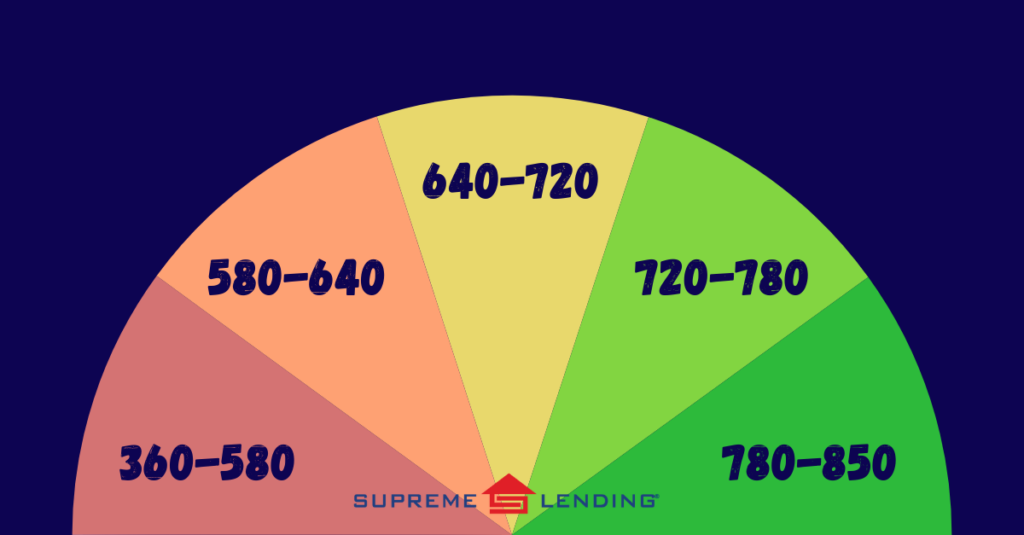

Commonly determined by FICO® score, credit scores are calculated using the borrower’s financial background information such as payment history, credit utilization, length of credit history, types of credit in use, and recent credit behavior. The average credit score in the United States in 2023 was 715, according to Experian data.

Down Payment Assistance Options

If a homebuyer doesn’t have the required minimum down payment or would like to access more financing, Supreme Lending offers several down payment assistance options for qualified buyers. This can also help first-time buyers open the door to homeownership. Guidelines and eligibility vary depending on the program. For example, the Supreme Dream program offers down payment assistance in the form of a fully forgivable second loan and requires a minimum credit score of 620. Ask your Supreme Lending Loan Officer about qualified assistance programs.

Understanding credit score and down payment requirements for different types of mortgages is crucial for prospective homebuyers. While each loan type has its own guidelines, maintaining a good credit score and having sufficient funds for upfront costs at closing remains a common denominator for securing favorable terms and interest rates. By proactively managing your credit and staying informed about your options, you can navigate the mortgage process with confidence on your journey to homeownership.

Contact your local Supreme Lending branch to get pre-qualified and learn about your home financing options.

by Supreme Lending | Aug 14, 2024

There are several things to consider when deciding to refinance* your mortgage. It’s essential that you’re well-informed and ready to make an educated home financing decision to reach your goals. Once you’ve established how soon you can refinance, here are seven other important considerations.

1. Home Equity: The Foundation of Refinancing

One of the first things to evaluate when deciding to refinance your mortgage is how much equity you have built in your home. Equity is the portion of the property that you truly “own”—the value of your home minus your mortgage debt. Typically, lenders require that you have at least 20% equity in your home to qualify for a refinance. If you haven’t built up sufficient equity, you may not be eligible or you may receive less favorable terms. Your home equity is especially important when considering cash-out refi loans.

2. Credit Score: Your Financial Passport

Your credit score is crucial when it comes to your mortgage and loan program requirements. Your credit reflects your financial history. It also helps lenders determine a borrower’s potential risk. A higher credit score may help you unlock a more favorable mortgage. Before applying for a refinance loan, understand where you stand with your credit. Also, ensure that you’re up to date on making other debt payments.

3. Debt-to-Income (DTI) Ratio: Balancing Your Financial Obligations

Lenders will also review your Debt-to-Income (DTI), which is the ratio percentage of your monthly income that goes toward paying debts. A lower DTI ratio can demonstrate to lenders that you’re capable of managing your current debts and have the ability to repay your mortgage. Generally, a DTI of 43% or less is preferred but some loan programs and lenders can be more flexible and accept higher ratios.

4. Closing Costs: The Price of Change

Refinancing isn’t free. Don’t forget about the closing costs and associated fees that come when you refinance your mortgage. These can include application fees, originating fees, appraisals, and more. These expenses can add up to anywhere from 2% to 6% of the loan amount. It’s vital to review these costs to determine if refinancing makes sense for you. A breakdown of refinance closing fees will be included in your mortgage closing disclosure.

5. Break-Even Point: Calculating the Payoff

Understanding your break-even point is essential when you refinance your mortgage. This is the point at which your possible savings from a new loan exceed the costs of refinancing. To calculate this, divide the total cost of refinancing by the potential monthly savings from the new monthly mortgage payment. The result is the number of months it may take to recoup the costs. If you plan to stay in your home past the break-even point, refinancing may be very beneficial.

6. Interest Rates: When Is the Right Time?

Interest rates are also a driving factor when deciding to refinance your mortgage. A general rule of thumb is that refinancing is worth considering if you can reduce your interest rate by at least 0.5% or more. However, every borrower’s situation is different, so it’s important to analyze how a new rate will impact your unique financial picture and monthly mortgage payments. There are other reasons to refinance beyond the interest rate.

7. Private Mortgage Insurance: Can You Remove It?

If you put less than 20% down payment on your initial mortgage, you’re typically required to pay for private mortgage insurance (PMI). This protects lenders in case of a default on the loan. It’s an additional cost to your monthly payments. However, if you have more than 20% equity built in your home, refinancing may help remove the cost of PMI and reduce your payments.

At Supreme Lending, we understand that deciding to refinance your mortgage is a significant step, and you deserve significant service. By carefully weighing these seven considerations, you’ll be in a strong position to make a decision that aligns with your desired outcomes. When you’re ready to discuss your mortgage and refinancing options, our team is here to guide you every step of the way.

*By refinancing an existing loan, total finance charges may be higher over the life of the loan.

by Supreme Lending | Jul 17, 2024

Download a copy of the refinance checklist here.

If you’re considering refinancing* your mortgage, there are several ways you can prepare beforehand to ensure a smooth, timely transaction. The refinancing process requires careful planning and organization, starting with gathering the necessary documentation. Just like applying for a traditional mortgage, lenders will require several documents to refi your loan. They’ll need to review your existing mortgage, finances, debts, and capacity to repay the loan. Here’s a general breakdown of what you’ll need to prepare along with a refinance checklist.

Understanding Your Goals of Refinancing

To refinance an existing mortgage essentially involves replacing it with a new one. The most important step of refinancing is to understand the outcome of your new home loan. Whether you’re looking to change the loan term, reduce the interest rate, or take out cash from your home equity, using a refinance calculator can help you get an estimate of associated costs and new monthly payment.

Refinance Checklist

When you’re ready to begin the refinancing process, it’s time to collect the documents needed to refinance. These include details to help lenders verify your income, current mortgage, debts, assets, and other documents depending on individual situations. Here’s a refinance checklist of basic documents to help guide you in preparing to refinance.

Income Documents

- Pay stubs, past 30 days

- W-2s, past two years

- Tax returns, past two years, if self-employed

- Profit and loss statement, if self-employed

- Social security, pension, disability, or other income verification, if applicable

Home and Mortgage Documents

- Mortgage statement

- Homeowners insurance declarations page

- Homeowners association (HOA) statements, if applicable

Identification

- Driver’s license or state-issued I.D.

- Social Security card

Debt Statements, If Applicable

- Credit card statements

- Student loan balance

- Car loan balance

- Personal loan balance

- Home equity loan

Asset Documents

- Bank statements (checking and/or savings accounts)

- Investment account statements

- Retirement account statements

- Proof of any large deposits or gift funds, if applicable

- Other asset statements

Other Situational Documents, If Applicable

- Bankruptcy documentation

- Divorce decree

- Child support or alimony payments

- Credit or employment gap explanation letter, if requested

- Proof of any rental income collected from investment properties

Simplify Your Refinancing with Supreme Lending

Navigating the refinancing process may seem overwhelming at first, but with Supreme Lending by your side, our experienced mortgage professionals can help guide you every step of the way. From ensuring you gather all necessary documents on the refinance checklist to providing timely updates on your loan status, we’re committed to providing a seamless mortgage experience.

Ready to take the next step in refinancing? Contact your local Supreme Lending branch to get started.

*By refinancing an existing loan, total finance charges may be higher over the life of the loan.

by Supreme Lending | Mar 13, 2024

The decision to refinance* your mortgage is a strategic move that can have a profound impact on your financial well-being. There are several types of situations when refinancing might provide specific benefits and unlock potential savings. It’s important that homeowners have a clear idea of the possible outcomes when considering a refinance. Let’s dive into a few of the most common reasons people may refinance, some of which may apply to your situation.

Getting a More Favorable Mortgage Rate

A key reason that homeowners refinance is to get a more favorable mortgage interest rate. This can be done by either securing a lower interest rate than your current mortgage or by switching from an adjustable-rate mortgage (ARM) to a fixed-rate loan. In both cases, this may lead to significant savings over the life of the loan and may even reduce the monthly mortgage payments.

When mortgage interest rates drop lower than your current loan, it’s important to note that there are several additional considerations to be aware of, including fees and upfront costs associated with refinancing as well as the amount of time left on your current loan. Working with a trusted lender that provides personalized, transparent refinancing details and costs will help you make an informed decision for your mortgage needs.

Changing the Terms of Your Loan

Another common reason people refinance is to change the terms of their loan. This may involve extending the length of the loan to lower monthly payments or shortening the loan term to pay off the mortgage quicker. Refinancing to a shorter-term loan may increase your monthly mortgage payment, so it’s important to consider your budget before making this decision.

Switching Loan Type

Some homeowners may refinance to opt for another loan type, for example moving from an ARM to a fixed-rate mortgage. Interest rates—and subsequently monthly mortgage payments—for an ARM can increase or decrease based on market conditions, so borrowers may be more comfortable switching to a fixed-rate mortgage that has a steady interest rate and monthly payment that won’t change.

Another scenario could be borrowers wanting to change from a government loan, such as FHA or VA, to a Conventional mortgage. This could be an effective way to save on some loan costs by removing required fees typically associated with government loans.

Removing a Co-Signer

If you required a co-signer to qualify for a mortgage, you may be able to remove them from the loan by refinancing after improving your eligibility to qualify for a loan by yourself. Not only does this free up the co-signer from their financial obligation, but it may also help you qualify for a lower interest rate on your loan, especially if your credit score improves when the co-signer is removed. This could lead to more favorable loan terms. Homeowners may also want to remove a co-signer in the event of a divorce resulting in one spouse assuming sole ownership of the home and full responsibility for the mortgage.

Removing Private Mortgage Insurance or Mortgage Insurance Premium

For those who put down less than 20% down payment for a home, a common requirement is carrying private mortgage insurance or PMI. This protects the lender in case the borrower defaults on the loan, but it also means an additional monthly cost that can add up over time.

With Conventional mortgages, you don’t have to always refinance to remove PMI. It can be removed after you’ve reached a certain equity threshold in the home—usually 20%. However, some mortgage programs, like FHA loans, require a Mortgage Insurance Premium (MIP) for the life of the loan. An FHA borrower would need to refinance to a Conventional mortgage to remove the MIP cost.

Cashing Out Equity

Finally, another popular way homeowners utilize refinancing is to cash out the equity that’s built up in the home. If you refinance an amount greater than what you owe on your home, you can receive the difference in a cash payment to be used as you wish. For example, you may use this cash to fund home improvements, pay off high-interest debts, or for other large expenses. How you use the cash is up to you.

It’s important to remember that cashing out equity will increase the amount you owe on your home and may also lead to a higher interest rate—factors that should not be overlooked.

As you can see, there are a variety of reasons why homeowners may choose to refinance their mortgage. It’s important to carefully consider your individual circumstances and financial goals before making a decision, as refinancing may not be right for everyone.

For more information on reasons to refinance, or to learn more about any of our mortgage programs and services, reach out to your local Supreme Lending team or contact us today.

*By refinancing an existing loan, total finance charges may be higher over the life of the loan.