by Supreme Lending | Nov 10, 2024

Your Quick Home Appraisal Checklist

When buying or selling a home, it’s important to understand the importance of a home appraisal during the mortgage process. Appraisals determine the value of a property based on various factors, ensuring buyers, sellers, and lenders are aligned on what the home is worth. Knowing what appraisers look for can help ensure a smooth mortgage process and avoid last-minute surprises or delays. Read on for an overview of the appraisal process including a home appraisal checklist for homeowners, buyers, and real estate agents to consider.

What Is an Appraisal?

An appraisal is an independent assessment of a property’s market value led by a licensed appraiser. The value is based on evaluating several aspects of the home, such as the condition, location, and recent sales of comparable properties in the area. The appraisal is an essential step of the mortgage process required by most lenders to verify that they’re not lending more than the home is worth. For buyers, a home appraisal can also offer reassurance that they are paying a fair price.

The Home Appraisal Checklist: What Appraisers Look For

Here’s a quick look at some key elements appraisers may consider when evaluating a property. You can use this guide when searching for a home or preparing to sell.

1. Home Size and Layout

- What is the total square footage and number of bedrooms and bathrooms?

- Is the layout of the rooms and spaces functional.

- Is there a finished basement or attic that adds to the livable space?

2. Exterior Condition

- Roof: Are there any missing shingles, leaks, wear and tear, etc.?

- Foundation: Are there visible cracks or settling issues?

- Siding, windows, and doors: Check for any damage, peeling paint, or outdated fixtures.

- Landscaping: Is it overgrown or neglected?

3. Interior Condition

- Walls, ceilings, and floors: Are there any cracks, stains, or general wear and tear?

- Kitchens and bathrooms: Is there any damage, outdated appliances, or broken equipment? Are there luxury upgrades that may boost the home’s value?

- Plumbing and electrical: Are the systems up-to-code, functional, and safe?

4. Lot Size and Usability

- How large is the lot?

- Is it safe and functional?

5. Upgrades and Amenities

- Are there any recent home improvements, such as a kitchen remodel, energy-efficient updates, or a new roof?

- Are there unique amenities such as a pool, outdoor kitchen, or wine cellar?

6. Safety and Compliance

- Appraisers will check for safety hazards or code violations.

- Factors like missing handrails, faulty wiring, or broken windows can negatively impact the appraisal.

7. Location & Neighborhood

- Appraisers will examine the property’s location, including proximity to schools, parks, shopping centers, and other amenities.

- Neighborhood conditions, crime rates, and overall desirability can also impact the value.

8. Comparable Sales (Comps)

- Appraisers will compare the home to the sales of similar properties in the neighborhood.

- Factors such as home size, condition, and location are considered to provide a rough benchmark.

Preparing a Home for an Appraisal: Tips for Sellers and Agents

Keeping the home appraisal checklist in mind, there are some measures that sellers or listing agents may consider to prepare for an appraisal and potentially maximize a home’s value.

- Make Minor Repairs As Needed. Fix any small but noticeable issues, such as leaky faucets, old paint, stained carpet, and broken hardware. Minor fixes may go a long way in improving a home’s appraisal value.

- Clean and Declutter. A clean, organized home allows the appraiser to focus on the property’s key features rather than clutter. This step can also enhance the home’s overall appearance.

- Highlight Recent Upgrades. If the home has undergone significant improvements, provide the appraiser with a list of updates, including the dates and cost of renovations.

- Provide Easy Access. Make sure that the appraiser can navigate to all areas of the home, including the basement, attic, and other outdoor structures.

Frequently Asked Questions About Appraisals

1. What is the difference between a home appraisal and a home inspection?

A home appraisal determines the market value of the property, which is essential for lenders to approve the loan amount. A home inspection, on the other hand, assesses the condition of the home and identifies any potential issues or repairs that may need to be addressed. While an appraisal focuses on value, an inspection focuses on the home’s livability.

2. What happens if the home appraises for less than the sale price?

If the appraisal comes in lower than the agreed-upon sale price, the buyer and seller may need to renegotiate. The buyer could request the seller to lower the price, or the buyer may need to pay the difference out of pocket.

3. Do you need an appraisal when refinancing?

Yes. When refinancing,* it’s essential to understand the home’s current market value, especially if you’re taking cash out of your home equity. The appraisal also plays a key role in determining the Loan-to-Value ratio, which can affect loan terms, interest rate, and whether private mortgage insurance may be required.

*By refinancing an existing loan, total finance charges may be higher over the life of the loan.

What’s Next?

A home appraisal is one of the most important steps in the mortgage process. Once the appraisal is complete, the report is submitted to the lender for review. The lender reviews the appraisal report to verify the property’s appraised value aligns with the loan amount. When all loan conditions are met, it’s smooth sailing to closing.

Whether buying, selling, or listing a home, understanding the home appraisal checklist can help make the mortgage process smooth and seamless.

For more information about mortgages and steps of the loan process, contact your local Supreme Lending team today!

Related articles:

by Supreme Lending | Nov 9, 2024

You’ve submitted your initial mortgage application, completed the necessary paperwork, and even had your home appraised. Now, you find yourself at the crucial stage of the loan process – underwriting. This is where the underwriter, acting as a gatekeeper for the lender, meticulously assesses your financial details to determine the risk of financing your home. In this article, we will explore the mortgage underwriting process, its significance, and what borrowers can expect during this critical phase.

Who Are Underwriters and What Do They Do?

Underwriters play a pivotal role in safeguarding the interests of the lender during the home loan process. Their primary responsibility is to assess your ability to repay the loan and evaluate the risk associated with lending money to you. They review various aspects of your financial profile, including your credit score, income, and the appraised value of the property. The goal is to ensure that borrowers are not taking on more mortgage responsibility than they may be able to handle.

Importance of Underwriting:

The housing crisis of 2008 highlighted the need for stricter underwriting guidelines. Loose regulations during that period allowed borrowers to access funds without adequate means to repay, resulting in widespread defaults. Today, underwriters adhere to stringent guidelines to help prevent the recurrence of such crises, protecting both borrowers and lenders alike.

What to Expect During the Underwriting Process:

Further Paperwork May Be Needed:

During the underwriting process, underwriters may request additional documentation to gain a comprehensive understanding of your financials. It’s crucial to provide any requested documents promptly to keep the mortgage process moving smoothly.

Turn-times Vary:

Depending on the loan type and market conditions, the underwriting process may take anywhere from 5 to 14 days. Understanding the potential timeline may help you manage expectations and plan accordingly.

Disclosure Mailings:

Borrowers may receive electronic or paper loan disclosures throughout the process. These disclosures are sent to ensure compliance with state and federal laws.

Loan Determinations:

After reviewing your application, the underwriter will issue one of three determinations:

Conditional Approval of Loan:

Your loan is cleared for funding, and your lender will discuss any remaining conditions specified by the underwriter. A closing date will be scheduled.

Suspension of Loan:

A suspension occurs when there are questions about a critical facet of your loan file. Your lender will work with you to identify and address any concerns, leading to a potential conditional approval.

Denial of Loan:

If your file indicates a high level of risk, the underwriter may deny the loan based on industry benchmarks, not personal intuition. For example, perhaps there was a significant drop in your credit score, indicating potential payment inconsistencies and a big risk for a lender.

What Happens If Your Loan Is Suspended or Denied?

Choosing the right lender is crucial, and at Supreme Lending, the relationship doesn’t end if your loan faces challenges. Supreme’s dedicated team may be able to help overcome underwriting objections, identify errors, and work with you to improve your application.

Understanding the mortgage underwriting process is vital for borrowers navigating the complex world of home loans. As you approach this final checkpoint, being prepared for potential requests for additional documents, varying turn times, and the possible outcomes of the underwriting review can help streamline the process. With Supreme Lending by your side, you can navigate the underwriting process with confidence and increase the chances of a successful loan closing.

Dos and Don’ts During the Mortgage Underwriting Process

The journey to homeownership involves various stages, and one of the most important steps is the mortgage underwriting process. This phase determines whether your loan will be approved or not. To ensure a smooth underwriting experience with Supreme Lending, it’s essential to follow a set of Do’s and Don’ts.

Do’s:

Maintain Consistent Debt Payments:

Make minimum monthly payments on your consumer debt until the loan closes. Any deviation from this may have adverse effects on your mortgage application.

Timely Mortgage Payments:

Ensure your mortgage payments are made on time and are no more than 15 days late. Any delay beyond this timeframe may pose risks to your loan approval.

Cooperate with the Title Company:

Respond to calls from the Title Company. Occasionally, there may be outdated or unreleased liens, which can complicate the ownership of your property. Addressing these issues promptly is vital for clearing your property’s title in preparation for closing.

Submit Requested Documents Promptly:

Provide any documents requested by Supreme Lending immediately. Timely submission is crucial, as documents can have expiration dates, and delays may affect your application.

Retain Financial Documents:

Hold onto electronic and paper copies of pay stubs, bank statements, and other financial documents until the loan closes. You may be required to provide them during the underwriting process.

Don’ts:

Avoid Job Changes or Retirement:

Refrain from resigning or retiring during the loan process without consulting your Supreme Lending mortgage expert. Changes in employment status may impact your loan approval.

No New Credit Accounts:

Do not open or apply for new credit accounts before your mortgage loan closes. New accounts or inquiries can be easily identified during underwriting and may jeopardize your application. Our experienced professionals understand that life happens, and should a need arise for situations such as applying for student loans or financing a child’s upcoming college tuition, we ask that you discuss your plans with a member of our team before you take action.

Avoid Balance Transfers:

Refrain from making balance transfers on existing credit card balances. Such actions may slow down the mortgage application process.

Don’t Pay Off Existing Credit Accounts in Full:

Avoid paying off existing consumer credit accounts (e.g. auto loans, credit cards, etc.) in full unless it aligns with the natural progression of making minimum monthly payments.

Successfully navigating the mortgage underwriting process requires careful attention to detail and adherence to specific guidelines. By following the Do’s and Don’ts outlined above, you may increase the likelihood of a smooth and successful loan approval. If you have any questions or concerns about your loan, don’t hesitate to reach out to the Supreme Lending team for assistance. Remember, open communication and timely action are key to a positive mortgage underwriting experience.

by Supreme Lending | Nov 7, 2024

For aspiring homeowners and first-time buyers, many questions can arise about the mortgage process. What credit score do you need to qualify? How much down payment is required? Answers are based on several factors including the property, purchase price, and, most importantly, the mortgage type.

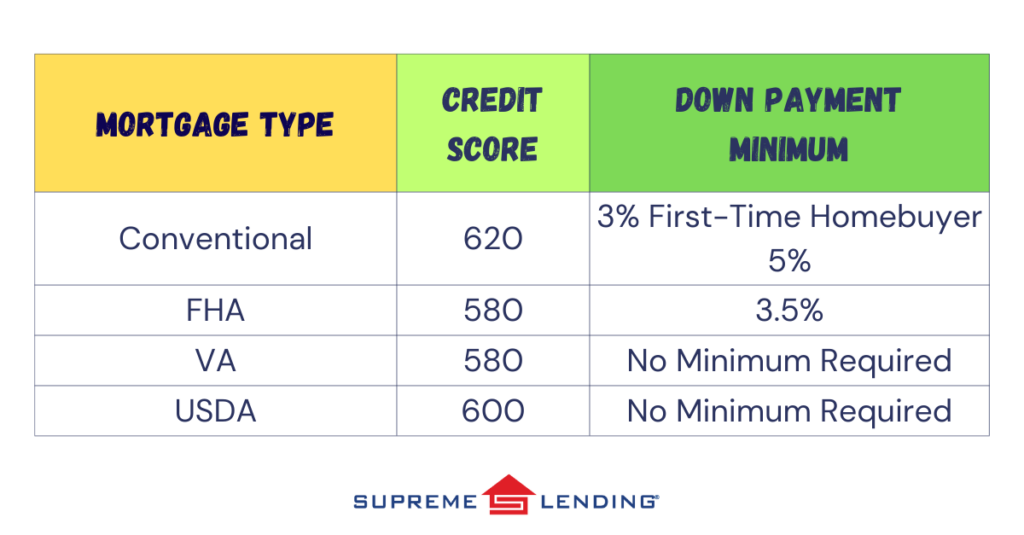

Here’s a breakdown to simplify the numbers and help you understand what you need to open the door to your dream home depending on common mortgage types:

What Is a Credit Score?

Commonly determined by FICO® score, credit scores are calculated using the borrower’s financial background information such as payment history, credit utilization, length of credit history, types of credit in use, and recent credit behavior. The average credit score in the United States in 2023 was 715, according to Experian data.

Down Payment Assistance Options

If a homebuyer doesn’t have the required minimum down payment or would like to access more financing, Supreme Lending offers several down payment assistance options for qualified buyers. This can also help first-time buyers open the door to homeownership. Guidelines and eligibility vary depending on the program. For example, the Supreme Dream program offers down payment assistance in the form of a fully forgivable second loan and requires a minimum credit score of 620. Ask your Supreme Lending Loan Officer about qualified assistance programs.

Understanding credit score and down payment requirements for different types of mortgages is crucial for prospective homebuyers. While each loan type has its own guidelines, maintaining a good credit score and having sufficient funds for upfront costs at closing remains a common denominator for securing favorable terms and interest rates. By proactively managing your credit and staying informed about your options, you can navigate the mortgage process with confidence on your journey to homeownership.

Contact your local Supreme Lending branch to get pre-qualified and learn about your home financing options.

by Supreme Lending | Nov 3, 2024

An Overview of Supreme Lending Credit Score Requirements

When you’re preparing to buy a home, understanding the mortgage credit score requirements is essential. Your credit plays a significant role in determining your eligibility for various loan programs, as well as interest rates you may qualify for. Our goal at Supreme Lending is to provide the smoothest mortgage experience possible, that includes guiding you with transparent information to help you to make an informed, confident decision. Here’s an overview of Supreme Lending’s credit score requirements for common loan programs and frequently asked questions.

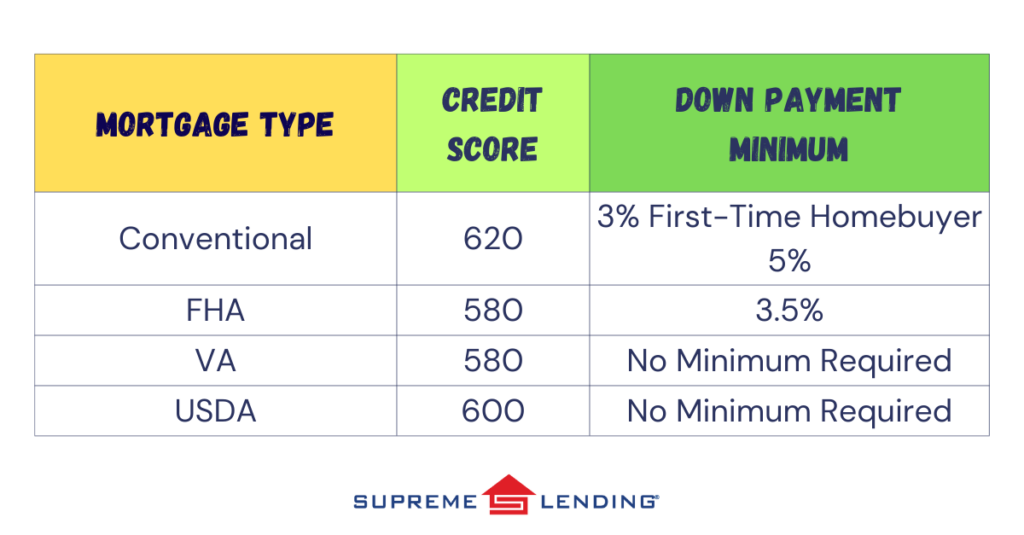

Conventional Loans

Conventional loans are popular among homebuyers due to their flexibility and competitive interest rates. As a general rule of thumb, Supreme Lending requires a minimum credit score of 620 for Conventional loans. However, a higher score typically results in securing more favorable rates and terms.

FHA Loans

Insured by the Federal Housing Administration, FHA loans are another common mortgage option –especially for first-time homebuyers or borrowers with lower credit. These loans have more lenient credit score requirements, accepting as low as 580.

VA Loans

For eligible military Veterans and active-duty personnel, VA loans offer affordable options as they don’t require a down payment or mortgage insurance premiums. Like FHA loans, Supreme Lending’s credit score requirement for VA loans is a minimum of 580.

USDA Loans

Guaranteed by the U.S. Department of Agriculture, USDA loans provide affordable financing designed for homebuyers in designated rural areas with no down payment required. In general, Supreme Lending’s credit score requirement for this program is 600.

Jumbo Loans

Jumbo loans are used to purchase high-value properties with a loan amount greater than conforming loan limits, which is $766,550 for one-unit homes in 2024. Due to potential higher lending risk, Jumbo loans typically have stricter qualifications. Supreme Lending has jumbo programs with a minimum credit score of 680, but depending on the loan guidelines, some may require at least a 720 credit score or higher.

Frequently Asked Questions

Now that you have a snapshot of common credit score requirements at Supreme Lending, here’s some more insight on how your credit can impact your mortgage.

How is a credit score determined?

A credit score, often represented by a FICO® score, is a numerical assessment of a borrower’s financial health. It is calculated based on several key factors:

- Payment History: Your record of on-time payments versus late or missed payments.

- Credit Utilization: The amount of credit you’re using compared to your total credit limits.

- Length of Credit History: The duration of time you’ve had credit accounts open.

- Types of Credit in Use. The variety of credit accounts you have, such as credit cards, mortgages, and car loans.

- Recent Credit Behavior. This includes how many new credit accounts you’ve opened recently and credit inquiries.

Combining these factors provides a numerical score to help reflect your creditworthiness.

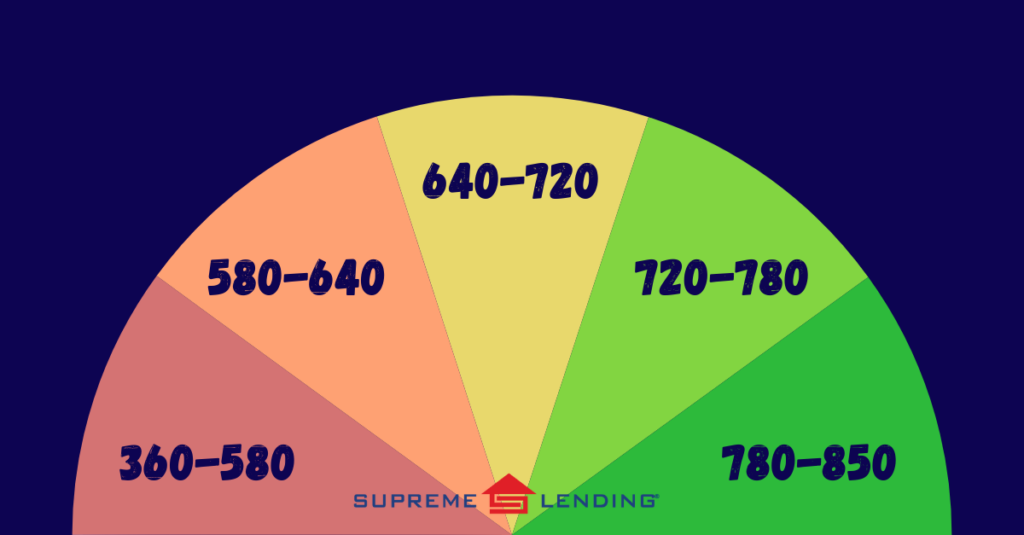

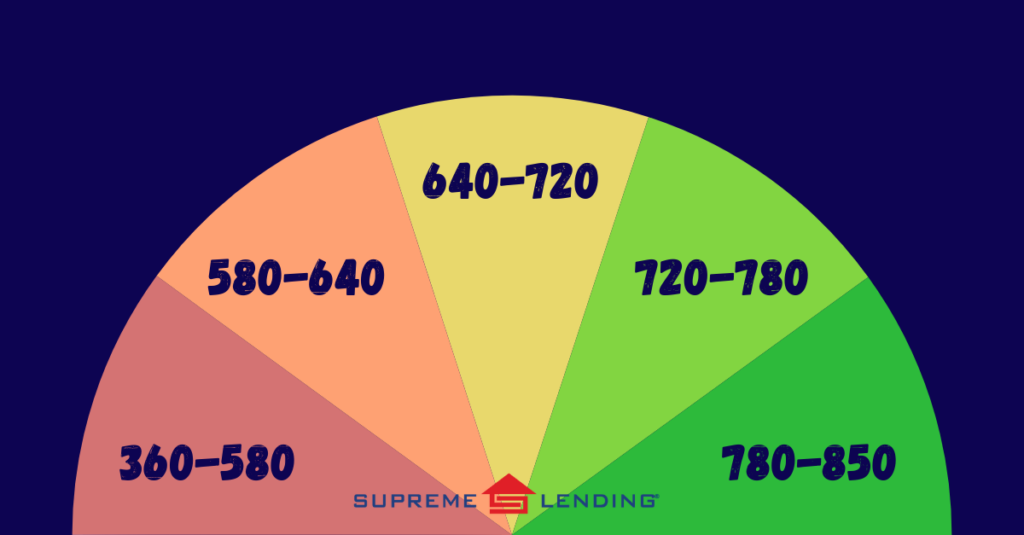

What qualifies as a generally “good” credit score?

In general, a credit score of 670 to 739 is considered good according to FICO® standards. Scores in this range suggest that you are a responsible borrower with a solid history of managing credit well. 740 or higher is considered very good or exceptional. Remember, a higher the credit score usually results in more favorable mortgage rates and terms.

Additionally, a credit score between 580 and 669 is considered fair. This range aligns with many of the credit score requirements outlined above depending on the loan type. So don’t fall victim to the common mortgage myth that you need perfect credit to qualify for a home loan.

What’s the difference between a soft credit pull and hard credit pull?

When applying for a mortgage, lenders need to pull your credit report. There are two ways to do this:

- A soft credit pull is a credit check that doesn’t affect your credit score. It’s typically used for pre-qualifications or when you check your own credit. Supreme Lending has this option when you get pre-qualified for a mortgage.

- A hard credit pull, on the other hand, occurs when a lender reviews your credit score as a formal credit application during the loan approval process. Hard pulls can temporarily lower your credit score by just a few points. However, there’s no significant impact, which is another mortgage myth to debunk.

Here to Help

Don’t navigate the mortgage process alone! Our experienced and knowledgeable team at Supreme Lending is here to help you understand all aspects of your homebuying journey. From understanding credit score requirements and determining which loan program may work for you to our seamless underwriting process, we help you close your loan with confidence.

Contact us today to get started!

Related articles:

Common Credit Score and Down Payment Requirements by Mortgage Type

FHA Loans vs. Conventional Mortgage: Which One Is Right for You?

by Supreme Lending | Nov 1, 2024

There are several important steps involved in the homebuying process, and an independent confirmation of the property’s value is a key step for mortgage approval. This evaluation is typically known as an appraisal. What is an appraisal, why is it done, and what else do you need to know about the appraisal process as a prospective homebuyer? Here are the basics.

What’s an Appraisal?

For those who have never been through the mortgage process before, an appraisal refers to an unbiased estimate of a home’s value. A professional appraiser evaluates the property to confirm its worth, which is then used to determine how much money can be loaned to the borrower through a mortgage.

In nearly all home purchases today, lenders require an appraisal before approving a loan. This is because they want to be confident that they’re not loaning more money than the property is worth, as this would put them at risk of loss if the borrower defaults on the loan.

Generally, appraisals are completed and filed within the jurisdiction in which the property is located. This is important to keep in mind if you’re considering a purchase in another city, county, or state, as different jurisdictions have different requirements and processes.

Why Are Appraisals Important?

As mentioned, appraisals play a vital role in the homebuying process as they provide an unbiased estimate of a property’s value. This number becomes incredibly important when negotiating a purchase price, as it can help confirm or refute the asking price set by the seller.

If you’re planning to obtain a mortgage to finance your home purchase, the appraisal value will also be used to determine how much funds you’re eligible to borrow. In some cases, the appraised value may be lower than the agreed-upon purchase price, meaning that the buyer would need to come up with the difference in cost.

Of course, it’s important to remember that appraisals may not always be 100% accurate. There is some subjectivity involved in the process, and different appraisers can sometimes come up with different values for the same property. That’s why it’s important for buyers to be aware of recent comparable sales in the area, as this can help them gauge whether or not an appraisal is fair.

What Do Appraisers Look for?

When an appraiser is assessing a property, they’ll be looking at several different things. Here’s a general list:

- Interior and exterior inspection: The appraiser will visit the property and conduct a thorough inspection, taking note of both the condition of the property and any features or amenities that may impact its value. This will cover both the interior and exterior of the property.

- Review of recent sales: The appraiser will also review recent sales of comparable properties in the area to get an idea of the current market value. These will be included in the appraisal report for review, along with a street map that shows the locations of those properties.

- Assessment of the property’s condition: The appraiser will also provide their opinion on the condition of the property, which can impact its value. Therefore, it’s important for sellers to make necessary repairs or improvements before putting their home on the market.

- Square footage calculation explained: Assessing square footage is another essential part of the appraisal process. The appraiser will determine the total square footage of the property as well as the livable space. This can sometimes be tricky, as there are different ways to measure square footage and some methods may result in a larger number than others. For this reason, appraisers are generally required to also include the method they used in determining the home’s square footage on the report.

- Photos: One of the most important parts of the appraisal report is the photos that the appraiser takes during their inspection. These provide a visual record of the property’s condition and can be helpful when reviewing the report.

The appraiser’s findings are presented in reports that typically are several pages and include other important information, such as the appraiser’s qualifications, contact information, and any licenses or certifications they may have.

Who Pays for Appraisal Costs?

Generally speaking, appraisals can run between $300-$700 for single-family homes, though the exact cost will depend on the appraiser and the property being assessed. In most cases, the buyer is responsible for covering the cost of the appraisal, though there are some instances where the seller may agree to pay. Homebuyers may have the option to roll the appraisal cost into their closing costs or possibly the mortgage itself.

For more information on the appraisal process, or to learn more about any of our mortgage products and services, contact your local Supreme Lending team today.

Related Articles: