Your Guide to the FHA 203(k) Renovation Loan Program

Discover the Program Highlights of an FHA 203(k) Renovation Loan

Are you ready to turn a fixer-upper into your dream home? Whether it’s a home you’ve just bought or already own, renovation loans like the FHA 203(k) program may help you finance both the purchase and necessary repairs or updates all in one mortgage. Plus, the U.S. Department of Housing and Urban Development (HUD) announced that it is increasing the loan amount for Limited FHA 203(k) loans to $75,000 on all FHA case numbers effective November 4, 2024—that’s up from $35,000 which is huge news!

Here’s an in-depth look at how the FHA 203(k) renovation loan works, the differences between the Limited and Standard options, and what types of renovations may be covered.

What Is an FHA 203(k) Loan?

Insured by the Federal Housing Administration, the FHA 203(k) renovation loan allows homeowners to finance the cost of both the property and its renovations in a single loan. Whether you’re purchasing a home that needs updates or making repairs to your current home, this loan program may help make those dreams a reality. It offers the similar benefits of FHA loans for first-time buyers and repeat buyers alike. To qualify, eligible borrowers only need 3.5% down payment and there’s more lenient credit score requirements than other renovation loans.

Limited vs. Standard FHA 203(k) Renovation Loan

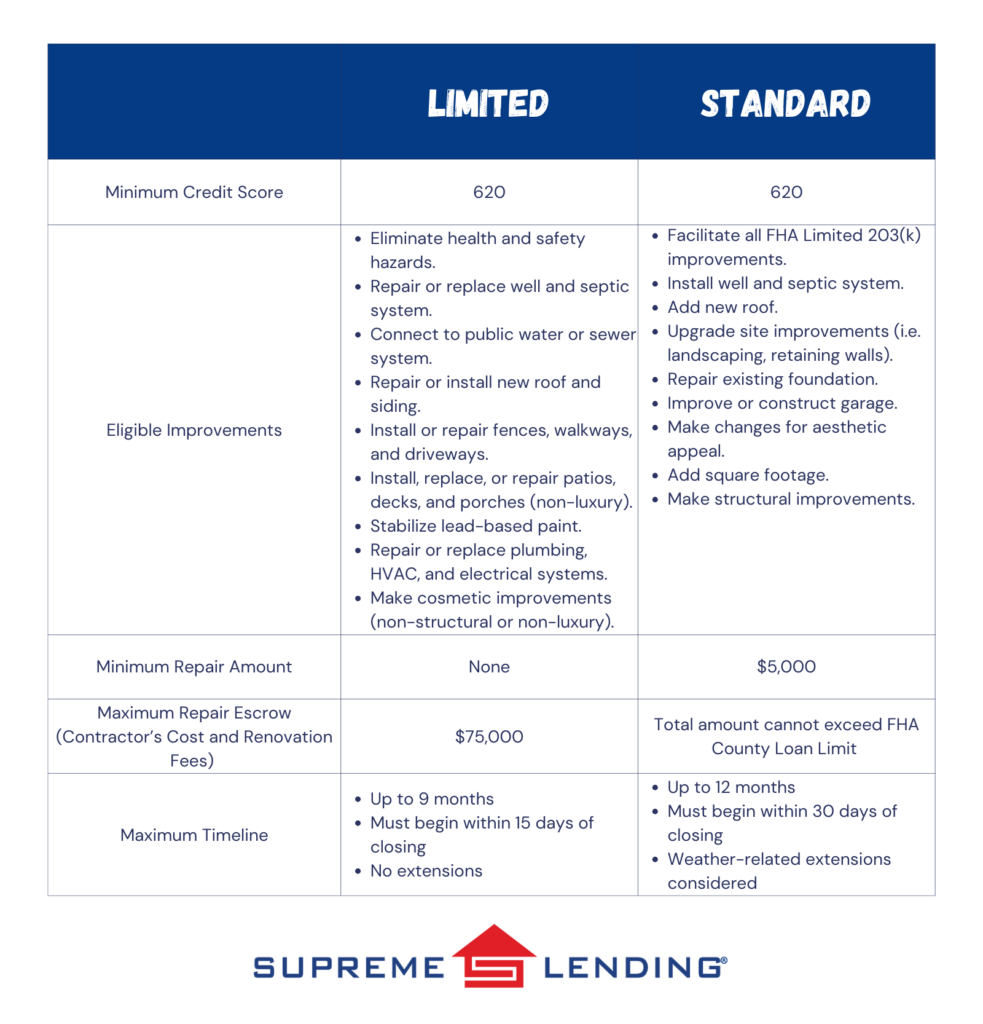

There are two types of FHA 203(k) loans—Standard and Limited. Each has specific uses and limits depending on the scope of renovations you can make.

Limited FHA 203(k) Loan

The Limited 203(k) option is commonly used for smaller repairs and cosmetic upgrades. As mentioned, the loan amount will increase to $75,000 in November 2024, an exciting enhancement that will help open the door to renovations for more people. This loan covers non-structural projects such as remodeling kitchen fixtures, replacing flooring, painting, and minor landscaping. Unlike the Standard, the Limited program doesn’t require working with an HUD consultant or have a minimum loan amount.

Common Projects the Limited Covers

- Minor remodeling (i.e. updating kitchens or bathrooms)

- Replacing appliances or flooring

- Repainting or refinishing surfaces

- Energy-efficient improvements (i.e. installing new windows or insulation)

- Repairing roofs and gutters

Standard FHA 203(k) Loan

The Standard FHA 203(k) Renovation loan is more ideal for homes needing larger renovations and structural repairs. These may include adding rooms, replacing outdated plumbing or electrical systems, and fixing major structural issues. It has a minimum of $5,000 that must be used for renovations and the total loan amount must be within the FHA County Loan Limit. Because these projects are typically more complex, you’re required to work with an HUD-approved consultant.

Common Projects the Standard Covers

- Structural repairs or additions (i.e. adding on square footage or fixing foundation issues)

- Major systems replacements (i.e. plumbing, electrical, or HVAC systems)

- Roof repairs or replacements

- Modernization and improvements to the home’s function

- Accessibility improvements for people with disabilities

How Does the FHA 203(k) Renovation Loan Work?

The process for applying for an FHA 203(k) loan is similar to a regular FHA mortgage but comes with a few additional steps. Here’s an overview of how this loan program works.

- Find a property. Whether it’s a home you already own and want to refinance* or one you’re planning to purchase, identify a property that needs renovations.

- Get an appraisal. The home appraisal will assess both the home’s current market value as well as it’s “as-completed” value after the renovations are completed.

- Contractor and Estimates. Work with a licensed contractor to obtain the estimated costs for the repairs and improvements.

- Loan Application. You’ll apply for the loan based on the combined cost of the home and repairs.

- Renovation Timeline. Once the loan is approved, the renovation funds are placed into an escrow account and work begins. The renovation timeline can typically range from six months to one year.

*By refinancing an existing loan, total finance charges may be higher over the life of the loan.

FHA 203(k) Combined with FHA 203(h) Disaster Relief Loan

Did you know that eligible borrowers affected by federally declared disaster areas may be able to combine the FHA 203(k) renovation loan with the FHA 203(h) disaster relief loan? This means adding the renovation costs into a new mortgage if your home was destroyed and deemed unlivable. Plus, the damaged property is eligible regardless of the age of the home. It only needs to have been a habitable residence prior to the disaster.

Ready to Rebuild?

At Supreme Lending, we understand how important it is to transform a home into one that truly meets your needs. Whether you’re fixing up a new property or renovating your current home, the FHA 203(k) renovation loan offers an excellent way to finance those improvements. We’re proud to offer both Standard and Limited options to fit the scope of your home projects.

Want to learn more about FHA 203(k) renovation loans or other mortgage options? Contact our team at Supreme Lending today and get pre-qualified!