by Supreme Lending | Oct 2, 2024

Deciding between renting vs. owning a home may be one of the biggest debates when it comes to housing. Both options offer unique advantages, but the key is to find which fits your personal goals and lifestyle. Let’s explore the pros and cons of each option and take a deep dive into the many potential benefits of homeownership and mortgage options that renters may not realize.

Pros and Cons of Renting

Renting offers flexibility and lower upfront costs, making it an appealing option for many. Here are some of the possible benefits and drawbacks of renting.

Pros of Renting

- Renting allows you to move more easily, ideal for those who frequently relocate or prefer not to be tied down to one area.

- Less Responsibility. When renting, your landlord or property management company is typically responsible for maintenance, repairs, and property upkeep. This saves you the headache of managing those tasks and additional costs.

- Lower Upfront Costs. When moving into a new rental, security deposits and first month’s rent are typically more affordable than a down payment for a home and other homebuying costs.

Cons of Renting

- No Home Equity. Making rent payments doesn’t build equity—unlike the potential for a home. No equity means you can’t take advantage of opportunities like cashing out on equity with a refinance.*

- Limited Personalization. Rental properties often have restrictions on renovations or even simple changes like painting walls and installing new fixtures.

- Rising Rents. Unlike a fixed mortgage, rent payments can oftentimes increase every year, sometimes significantly depending on your local market conditions.

Benefits of Owning

While renting may offer short-term convenience, owning a home comes with several potential long-term benefits that renting can’t match. Beyond simply having a place to live, explore these rewards of homeownership:

- Potential to Build Equity. Home values may appreciate over time. Unlike renting, homeownership may allow you to build equity as a future investment.

- Stable Payments. With fixed-rate mortgages, you have the confidence and peace of mind that your monthly payments will remain the same throughout the life of the loan.

- When you own your home, you have the creative freedom to really make it your own. You can make as many home renovations as you want to fit your unique style.

- Possible Tax Benefits. Homebuyers may qualify for potential tax deductions. Work with your tax advisor to learn more and see if owning a home could save you tax dollars.

- Pride of Ownership. There’s a unique sense of accomplishment and pride that comes with owning a home, allowing you to put down roots in a community.

Renting vs. Buying: Seven Key Questions to Consider

- How long do you plan to stay in one place? If you’re planning to stay in one location for several years, buying may be a smarter option.

- What’s your financial situation? Do you have enough savings for a down payment and closing costs? Evaluate your finances and get pre-qualified to determine your options.

- Are you ready for the responsibilities of homeownership? Owning a home comes with additional responsibilities than renting such as on-going maintenance, repairs, and upkeep.

- What’s your credit score? Your credit score plays a significant role in qualifying for a mortgage and getting favorable loan terms.

- What are the housing market trends in your desired area? Depending on your local area, it may make more sense to rent if housing prices are too high or out of your budget.

- Do you value flexibility or stability more? Consider your current lifestyle preferences. If you’re not ready to settle down, renting may offer the flexibility you need. However, if you’re drawn to a more stable living situation, homeownership may be the better option.

- What are your long-term goals? How could homeownership fit in with your broader financial and lifestyle goals, such as the potential to building equity, undergoing home renovations, investing in real estate, or creating a family home.

Down Payment Assistance & First-time Homebuyers

Don’t forgot to explore down payment assistance and first-time homebuyer programs that may help open the door to homeownership sooner than you think! FHA loans offer several benefits for first-time buyers, including lower down payment and credit requirements. While Conventional loans may only require as low as 3% down for qualified first-time buyers.

Ready to Stop Paying Your Landlord’s Mortgage?

Deciding between renting vs. owning a home is a big decision that depends on several factors such as your mortgage qualification, long-term plans, and personal preferences. While renting offers flexibility, homeownership may offer long-lasting benefits.

Ready to explore your homebuying options? Contact our team at Supreme Lending to discuss how to make your mortgage work for you!

*By refinancing an existing loan, total finance charges may be higher over the life of the loan.

by Supreme Lending | Oct 1, 2024

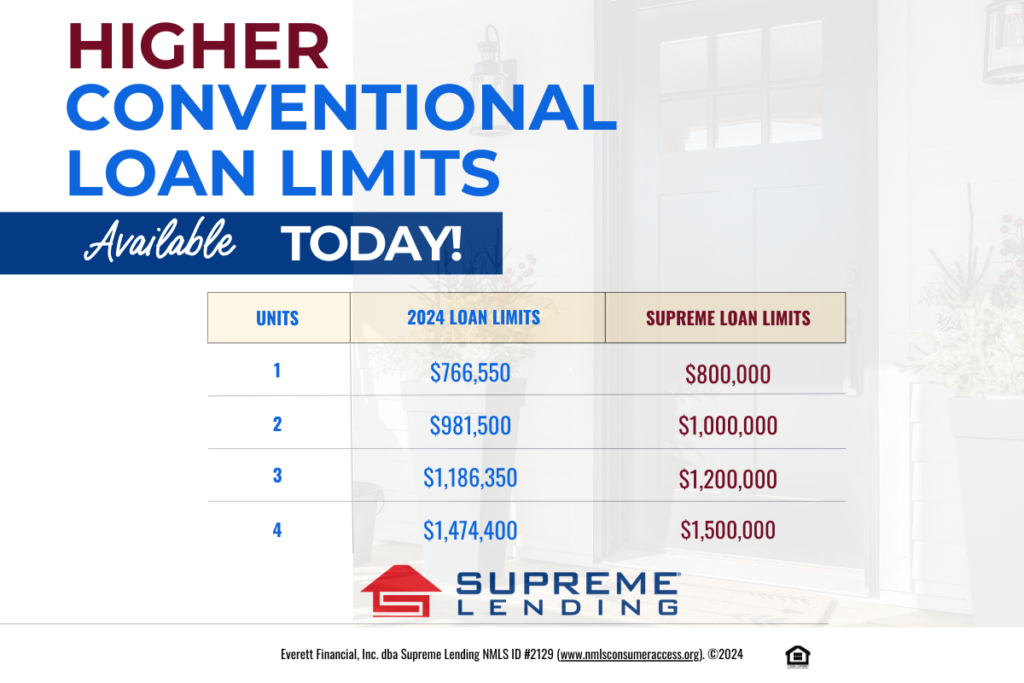

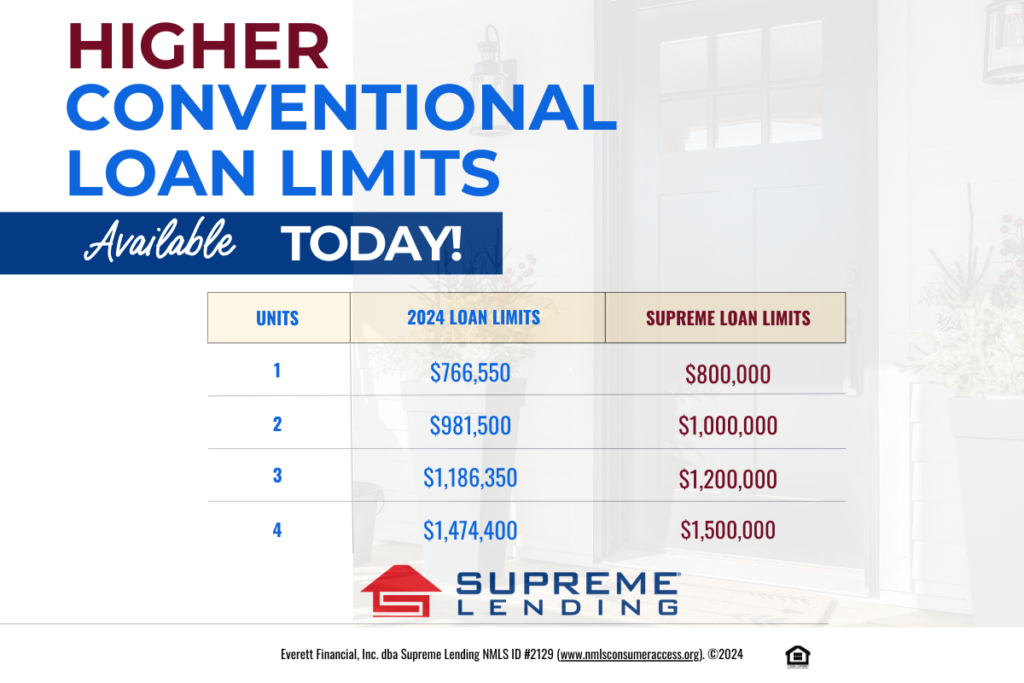

Supreme Lending is proud to announce the conforming 2025 loan limits have increased and, the best part, the company is offering the raised loan limits today. For single unit properties, the conforming limit is now $800,000, up from $766,550.

While Fannie Mae and Freddie Mac will not officially announce the 2025 conventional loan limits until the end of November, we’re pleased to honor these new limits now – empowering more people to achieve homeownership as home prices rise. You may not have to wait until next year to make your homeownership dreams come true!

Supreme Lending 2025 Loan Limits Available Now

- 1-unit property – $800,000

- 2-unit property – $1,000,000

- 3-unit property – $1,200,000

- 4-unit property – $1,500,000

The increase is effective on all new loan applications taken on or after Wednesday, September 25, 2024.

What Are Conforming Loan Limits?

Conforming loan limits set the maximum amount borrowers can finance their home while still qualifying for a conventional loan backed by Fannie Mae or Freddie Mac. Why does this matter? Staying within these limits may result in more favorable terms, including competitive rates, easier qualification standards, and lower down payment requirements.

What Happens When You Exceed Loan Limits?

If you need a loan higher than the conforming limits, you may consider a Jumbo loan. This is a good option for larger home purchases—especially in high-cost housing markets. Jumbo loans can typically require a higher credit score or larger down payment amount.

Ready to Get Started?

The increased conforming 2025 loan limits are designed to keep pace with rising home prices, making homeownership more attainable for borrowers looking to finance higher amounts while still benefiting from conventional loan advantages.

Whether you’re a first-time homebuyer or looking to upgrade, these new limits may open doors to more flexible financing options. If you have any questions or want to see if you qualify for the new, higher loan limits, contact us today to get started! We’re here to help guide you through the loan process every step of the way.

Contact your local Supreme Lending branch today!

by Supreme Lending | Sep 30, 2024

Buying a home is a major milestone, and while most prospective buyers are focused on saving for the down payment, there are additional homebuying costs to consider. From closing costs to ongoing home maintenance expenses, it’s important to understand the costs beyond the down payment. Let’s dive into those homebuying costs so you can be well prepared.

Down Payment: The First Major Cost

The down payment is often the largest upfront cost when buying a home. The down payment requirements depend on the type of loan to determine what you may qualify for.

- Conventional loans typically require at least 5% for eligible borrowers. For first-time homebuyers, the minimum requirement can be as low as 3%.

- FHA loans require as little as 3.5% down, making them a popular choice for borrowers looking for more flexible guidelines.

- VA and USDA loans offer no down payment requirement for eligible military veterans, active military, or buyers in defined rural areas.

Plus, there are several down payment assistance programs available to help more people achieve their dream of homeownership. While the down payment is a key part of purchasing a home, it’s not the only cost to keep in mind.

Closing Costs: Hidden Homebuying Fees

Beyond the down payment, closing costs are another significant upfront expense buyers must account for. These are fees and expenses necessary to finalize your home purchase and close the loan. Closing costs typically range from 2% to 6% of the home’s purchase price. Here’s a breakdown of common closing costs:

- Loan origination fee is charged by your lender for processing your mortgage.

- Appraisal fee covers the cost of having your home professionally appraised to determine its market value.

- Home inspection fee is paid to inspect the home for any necessary repairs or safety hazards.

- Title insurance and search fees ensure the property’s title is clear of any disputes or liens.

- Escrow fee is charged by the third party handling the closing process.

- Property taxes and homeowners insurance are typically prepaid for a portion of the costs at closing so they’re included in your mortgage escrow account.

Ongoing Costs of Homeownership

After closing on your mortgage, owning a home comes with ongoing expenses that many new buyers often overlook. These homebuying costs are essential to consider when planning for the long-term.

- Utilities include monthly bills such as electricity, gas, water, and internet. These are widely dependent on the size and location of your home.

- Landscaping and yard maintenance, whether you hire a service or handle it by yourself, keeping up with lawn care, tree trimming, and other outdoor maintenance can add up.

- Homeowners Association (HOA) fees are required when your property is in a community with an HOA. These fees may be monthly or annual and cover community maintenance and amenities.

- Property taxes are ongoing local government taxes based on the assessed value of your home. Property taxes may increase over time, so review your tax bills carefully.

- Homeowners and mortgage insurance are often required. Homeowners insurance helps protect the home in the event of potential damages, while mortgage insurance protects the lender in the event of a loan default.

- Ongoing maintenance and repairs will occur over time, from replacing appliances to fixing the roof or plumbing. It’s smart to set aside funds for common home upkeep expenses to avoid hidden costs surprising you.

What’s Next?

We hope these additional homebuying costs are not so hidden anymore! The journey to homeownership comes with several financial considerations beyond the down payment. By understanding these homebuying costs, you can be prepared to buy with confidence.

If you’re ready to explore your mortgage options, contact Supreme Lending today. We’re here to help guide you through the loan process and beyond.

by Supreme Lending | Sep 20, 2024

Can repeat buyers qualify for FHA loans?

When you think of an FHA loan, it’s often associated with first-time homebuyers. After all, FHA loans are widely known for lower down payment and flexible credit requirements. But did you know that FHA loans are not just limited to first-time homebuyers? Insured by the Federal Housing Administration, FHA loans are available to anyone who meets the guidelines, including repeat buyers.

Whether you’re upgrading to a larger home, downsizing, or simply moving to a new area, FHA loans can still be a valuable mortgage option for eligible borrowers. However, there are some caveats. Let’s explore why repeat buyers may consider an FHA loan, how it works, and answer a few frequently asked questions.

FHA Loan Benefits for Repeat Buyers

Lower Down Payment

One of the key benefits of an FHA loan is the down payment requirement as low as 3.5% of the purchase price for qualified buyers. For repeat buyers who may have limited equity from a previous home sale or do not want to pay for a sizable down payment, this lower down payment may be appealing.

Flexible Credit Score

FHA are also known for their flexibility when it comes to a borrower’s credit score. While Conventional loans typically require a score of 620, the minimum for FHA loans is 580.

Competitive Rates

FHA loans often come with competitive interest rates, even for buyers who may not have top-tier credit. Locking in a lower rate may make a significant difference in the monthly mortgage payment and may result in potential savings over the life of the loan.

Assumable Loan

One of the most unique features of an FHA loan is that it’s assumable. This means that if you sell your home in the future, the buyer can essentially take over your FHA loan, including the rate, if they qualify. When you’re looking to sell the home, this could make the offer more attractive to potential buyers, especially if interest rates are higher than when you purchased the loan.

Gift Funds

FHA loans also allow mortgage gift funds to be used for 100% of the down payment or closing costs. In this case, family members or other eligible donors may give you the money to cover the upfront costs with no repayment obligation.

FHA Loans for Repeat Buyers: Frequently Asked Questions

Can non-first-time homebuyers use an FHA loan?

Yes, FHA loans are not reserved exclusively for first-time homebuyers. As long as the property is your primary residence and you meet the income, credit, and other qualifications, you may consider an FHA loan – regardless if it’s your first home or not.

Can FHA loans be used for second home or investment properties?

FHA loans are designed for primary residences only, which means you cannot use them to buy a second home or an investment property.

Can I have more than one FHA loan at a time?

In general, FHA only allows you to have one active FHA loan at one time. This is because the mortgage is designed for primary residences only. However, there may be exceptions such as relocating for work, a growing family, or having been a co-signer. Each situation is unique and requires proof to qualify for an exception. That’s why it’s important to work with a knowledgeable lender to go over your options.

Do FHA loans require mortgage insurance?

Yes, FHA loans require both an upfront mortgage insurance premium and ongoing monthly mortgage insurance payments. These payments help protect the lender in case of a default on the loan. Unlike private mortgage insurance for Conventional loans, FHA mortgage insurance premiums typically remain for the life of the loan unless you refinance into a non-FHA mortgage.

Ready to Take the Next Step?

The journey of homeownership doesn’t end after your first home purchase. Even if you’re not a first-time homebuyer, discover how FHA financing may still help open the door to your next home. Contact Supreme Lending today to get pre-qualified.

Related Articles:

by Supreme Lending | Aug 20, 2024

When homeowners think about tapping into the equity they’ve built in their property, a Home Equity Line of Credit, also known as a HELOC, may come to mind. This alterative transaction mortgage can be incredibly versatile and useful for eligible homeowners to access funds. However, it’s important to understand exactly what a HELOC is and how it works when deciding if it’s the right option for you. Let’s explore how you may benefit from using a Home Equity Line of Credit.

What Is a HELOC?

A Home Equity Line of Credit (HELOC) allows homeowners to borrow against the equity in their home, essentially turning part of their home’s value into cash. Unlike a traditional home loan, a HELOC functions similar to a credit card. Homeowners can borrow, repay, and borrow again up to a maximum credit limit. A HELOC is meant to use toward large expenses such as home renovations, tuition, or paying down other debts with higher interest.

How Does a HELOC Work?

A HELOC has a designated draw period, which is the time during which you can borrow money. This period is typically the first 10 years of a 30-year term. During this time, you’re only required to make interest payments on the amount you borrowed, which is significantly less than other loan types. Although, you may be able to pay down your principal with no penalty, which can result in lowering your minimum monthly payment.

After the draw period ends, the repayment period begins. This is when you can no longer draw money out and need to start paying back both the principal and interest of the loan. This new minimum payment will ensure the balance is paid in full by the maturity date. Interest rates on HELOCs are variable, meaning they change over time due to market conditions and set margins. As a result, the monthly payments can fluctuate.

Who Might Consider a HELOC?

HELOCs are a flexible financing option that may be attractive for homeowners who need access to funds for various reasons, including:

- Home Improvements. If you’re planning to remodel your kitchen, add an extension, or make other home renovation projects, a HELOC could provide the necessary funds.

- Pay Off High-Interest Debt. HELOCs often have lower interest rates than credit cards or personal loans, which makes them a good option to pay off other debts.

- Education Expenses. If you or your children need assistance paying for tuition, a HELOC may provide a helpful solution.

- Unexpected Expenses. A HELOC can also serve as a financial safety net for unseen expenses, such as medical bills or emergency repairs.

Supreme Lending HELOC Options

Did you know that Supreme Lending offers different types of HELOC programs? In addition to a standard HELOC, there is also a program specifically designed for home renovations, which uses the home value after improvements. There is also an option to tap into a line of credit on current investment properties.

HELOC Pros and Cons

Pros:

- Flexibility. You can borrow as much or as little as you need up to your limit during the draw period.

- Interest-Only Payments. During the draw period, borrowers have the option to only pay interest, which results in lower monthly payments compared to traditional loans.

- Potentially Lower Rates. HELOCs typically have lower interest rates than credit cards and personal loans, offering affordability.

Cons:

- Variable Rates. HELOCs have variable interest rates, which means they can change. If rates increase, so will the monthly payments.

- Risk of Foreclosure. When using a HELOC, you’re using your home as collateral. Therefore, if you default on the payments, you could risk losing your home.

- Potentially Overspend. Easy access to credit and funds may lead to overspending, which could put the home at risk.

HELOC vs. Cash-Out Refinance: What Is the Difference?

A cash-out refinance* is another way to tap into your home’s equity, but it works differently from a line of credit. With cash-out refi loans, you replace your existing mortgage with a new one for more than you currently owe. In turn, you receive the difference in cash. Explore when you may want to choose a HELOC or a cash-out refinance.

Key Differences

- Loan Structure. A HELOC is a revolving line of credit, while a cash-out refinance is a one-time lump sum.

- Interest Rates. Refinancing can offer fixed interest rates to maintain predictable, stable monthly payments. Unlike a HELOC, which involves variable rates.

When to Choose One Over the Other?

- HELOC. You may consider a home equity line of credit if you have ongoing expenses or projects that don’t need all the funds at once. For example, home renovations, you can use the funds on an as-needed basis.

- Cash-Out Refinance. This is best if you prefer a fixed-rate and want a large sum of money upfront instead of opening a line a credit.

Frequently Asked Questions

How much can I borrow with a HELOC?

The amount you can borrow depends on your home’s value, the amount you owe on your current mortgage, your credit score, and the program’s guidelines. Typically, you can borrow up to 85% of your home’s equity if you qualify.

Are there fees associated with it?

Yes! Similar to closing costs with traditional mortgages, there may be fees for a HELOC such as an application fee, appraisal cost, and potential annual fees.

Can I pay off a HELOC early?

Yes, most HELOCs allow for early repayment with no penalty costs. Be sure to confirm the details with your loan officer.

How does a HELOC affect my credit score?

A HELOC can impact your credit score depending on how you manage the credit line. Timely payments may boost your score, while missed payments can harm it.

Is it tax deductible?

Interest on HELOC loans may be tax deductible. Please consult with your tax professional for more details.

What happens if I sell my home?

If you have a HELOC and then sell your home, you’ll need to pay it off in full. You could use the proceeds of the sale toward the HELOC.

Ready to Unlock Your Home Equity Line of Credit?

A HELOC may be a strategic financial tool for homeowners needing to access funds. Whether you’re paying for home renovation projects, education, or other significant expenses, a line of credit offers flexibility when you need it. However, it’s crucial to weigh the pros and cons, understand potential risks, and compare your options.

Want to learn more about HELOCs or other mortgage services? Contact your local Supreme Lending branch. We’re ready to help!

*By refinancing an existing loan, total finance charges may be higher over the life of the loan.